Crack Spreads Rise – Will Refiners Follow?

Oil prices are ticking flat/higher this morning as markets continue focusing on oil production losses in countries like Iraq and Libya. In addition, OPEC’s estimated deal compliance is sitting at 85% for January so far, an improvement over December’s 75% compliance. With substantial quantities of crude being kept off the market, the short-term fear of lockdowns has not shaken the oil price rally.

Fuel price gains are outpacing crude this morning, aiding the recovery of 3:2:1 crack spreads, which represent a refiner’s profit from converting 3 barrels of WTI crude into 2 barrels of gasoline and 1 barrel of diesel. In 2020, crack spreads fell to historically low levels, causing financial difficulties for refiners. Typically, crack spreads don’t stay below $11/bbl very long, yet in 2020 spreads fell as low as $2/bbl at some points. Over the past few weeks, spreads have risen, climbing above $13/bbl this week.

When crack spreads rise, refinery utilization typically follows. So far, refiners have been keeping utilization lower to prevent an overwhelming over-supply of refined fuels. Rising crack spreads suggest the market is ready to start absorbing a bit more fuel, which means refiners may increase their throughput. In 2020, many refineries shut entirely or switched to create other products, and those outages should keep utilization to a minimum in 2021. Refiners have a tough line to balance – too much fuel production will collapse spreads again, but too little fuel will hamper business profits.

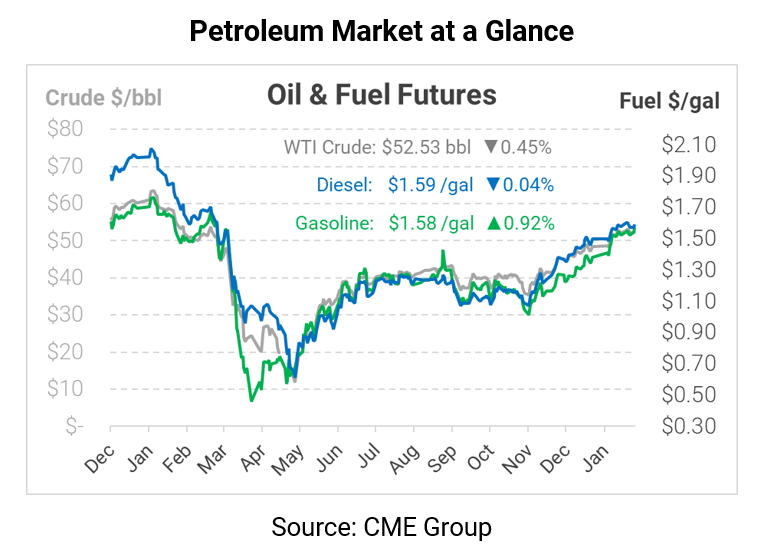

This morning, crude oil prices are trading flat, leaving fuel to carry the oil complex higher. WTI crude is trading at $52.53, down 24 cents from Monday’s closing price.

Fuel prices are flat/higher this morning, with gasoline leading the way. Gasoline is trading at $1.5755, up 1.4 cents since Monday. Diesel, like crude, is trading flat, with current prices at $1.5932.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.