China, 60% Back to Work

Crude prices are relatively flat this morning after yesterday’s large drop, the largest drop in almost seven weeks. Investors are trying to gauge the economic consequences of the quickly spreading coronavirus and whether it will become a global pandemic. Goldman Sachs says certain economic metrics appear at least 20% below what is normally seen this time of the year; however, local government data suggests that approximately 60% of all companies are back to work as of this week, showing some signs of progress.

Goldman Sachs spoke with multiple refineries and industry experts to better assess the latest refining demand-supply situation in China; Key takeaways include: 1) utilization and restart rate remained low for Shandong refiners; 2) there are signs of a faster pace of recovery for the domestic diesel market; 3) gasoline inventory is still high due to less traffic flow; and 4) refined product exports could increase from China.

Processing rates at independent refiners in China’s Shandong province have slumped to the lowest level in more than four years as the coronavirus saps demand for fuels; the oil processors cut runs to about 42% of capacity through the week ended February 21st, the lowest since September 2015. (Bloomberg)

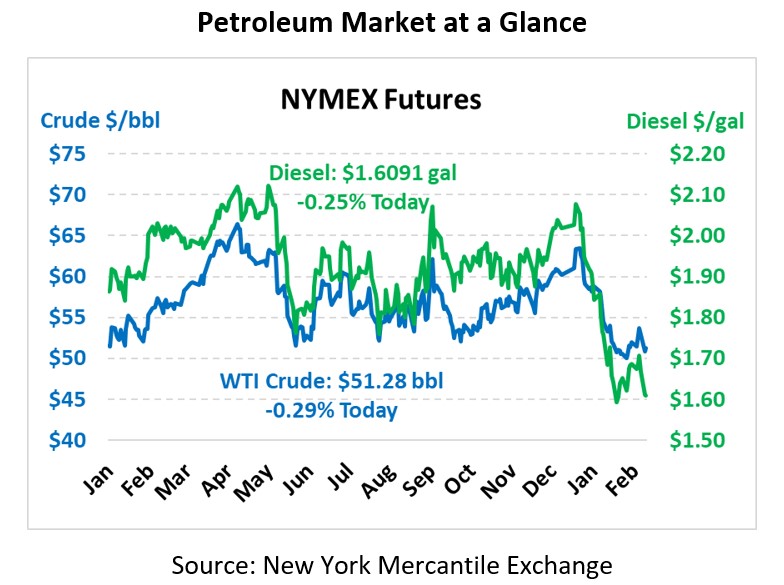

Crude prices are down this morning. Crude is currently trading at $51.28, a loss of 15 cents.

Fuel prices are down. Diesel is trading at $1.6091, a loss of 0.4 cents. Gasoline is trading at $1.6042, a loss of 0.5 cents.

This article is part of Crude

Tagged: China, coronavirus, fuel prices, Goldman Sachs

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.