Chicago ULSD – Volatile Over the Past Three Months

By Chris Carter, Senior Manager of Supply

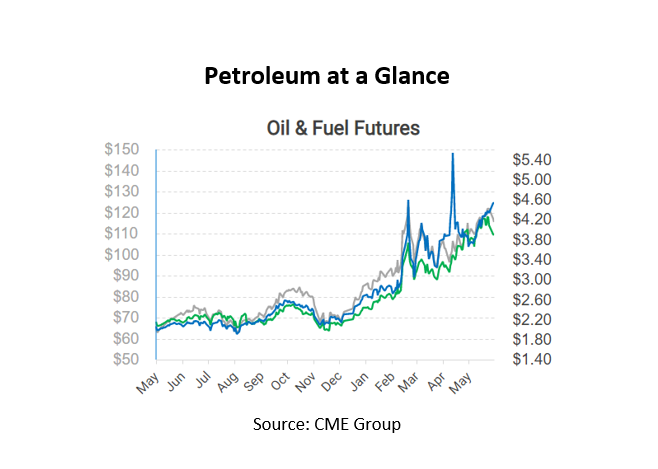

Like all markets, Chicago ULSD Basis has been volatile over the past 3 months. Chicago Basis has traded as low as 30 cents per gallon below Prompt NYMEX HO Futures. Then traded as high as 18 cents per gallon over NYMEX. Chicago refineries are in a unique position compared to surrounding markets. Chicago has the ability to take advantage of the Canadian crude, which trades at a discount to WTI. As a result, this discounted crude improves their refinery margins. Yet as production increases, refiners are restricted on where products can be transported. Unlike other regions, Chicago refiners do not have the ability to easily export. As a result, a lower basis value will help pull demand from surrounding regions.

The Chicago region did experience wet and “cooler” temperatures in March. The cooler temps delayed the normal spring planting demand. Yet, once planting season started, the market experienced refinery hiccups. Toledo BP/Cenovus went down for a planned multi-unit turnaround on May 1st. Additional refineries in the market had refinery issues over the past two months. Those issues combined with Toledo’s planned turnaround had an impact market.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.