Biden Calls for Diplomatic Meeting with Putin

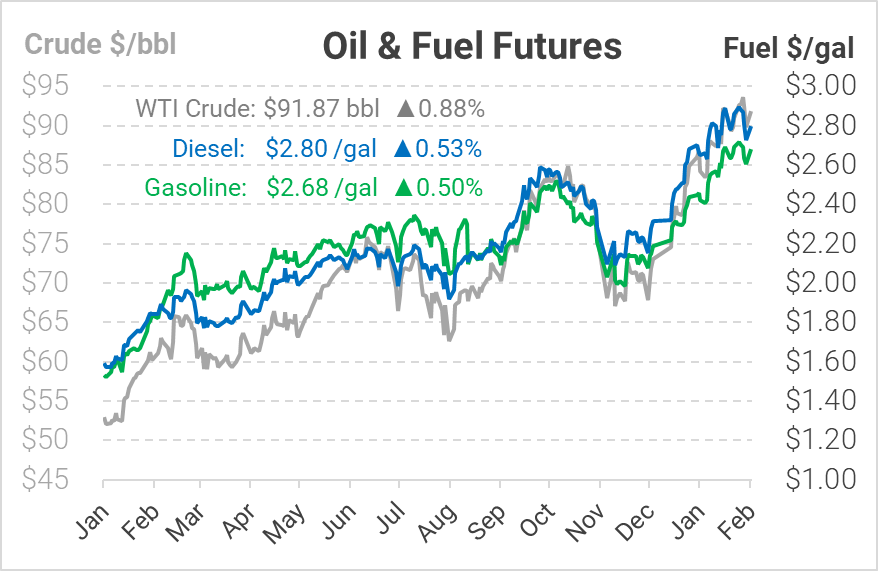

This morning oil prices are up as an imminent Russian invasion of Ukraine is becoming more likely. In the wake of tensions between Russia and NATO, President Biden and his administration have called for an in-person meeting with Putin to discuss diplomatic solutions to prevent war in Europe. Biden’s meeting is contingent on Russia not invading Ukraine in the short-term, so all bets are off if tensions continue escalating.

The timing of the meeting comes as U.S. Secretary of State Antony Blinken is set to meet with Russian Foreign Minister Sergey Lavrov on Thursday. The French government brokered the potential Biden-Putin summit after members of their government met with Russian officials just over a week ago. While Russia has made it clear through their troop movements on the border and war games in Belarus that they are not planning on standing down anytime soon, White House officials want to make it clear to the Kremlin that they are always open for diplomatic solutions. In a surprising statement amid hostility in Eastern Europe, China has also publicly expressed its discontent with a Russian invasion of Ukraine. They have stated that, like any “sovereign” nation, Ukraine should be respected and left alone.

With Biden preparing for a potential meeting with the Russian leader, at the same time he is working closely with his administration on severe economic sanctions for Russia. These sanctions could wither the Russian economy while shoving all of the wealth Putin has accumulated thus far during his tenure under the rug. With Europe receiving near 40% of gas and 26% of oil needed from Russia, Putin is ready to counter a possible sanction of his natural resources with re-routing supply channels. Aside from oil and gas sanctions, the U.S. and NATO have finalized a sanction package that would include Russian banks, technology, and oligarchs. While the world waits to see what will come of the entire situation, it is clear that the market impact from such an event would have worldwide effects.

This article is part of Daily Market News & Insights

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.