Surprise Draw is Moving the Markets

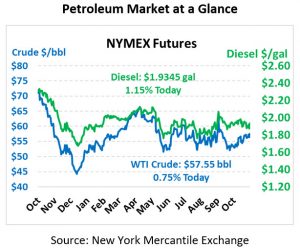

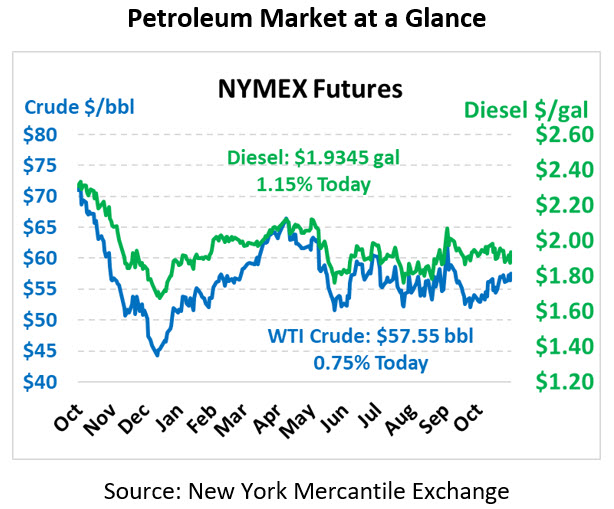

A surprise draw in crude stocks is putting upward pressure on prices this morning. WTI Crude is trading at $57.55 a gain of 43 cents.

Fuel is up this morning. Diesel is trading at $1.9345, a gain of 2.2 cents. Gasoline is trading at $1.6456, a gain of 0.9 cents.

Crude prices rose after the Secretary General for OPEC Mohammad Barkindo said on Wednesday that there would likely be downward revisions of supply in 2020, especially from US shale, adding that some US shale oil firms see output increasing by only 300-400 kbpd. The markets are up in early trading on Thursday based on bullish inventory data from the API yesterday evening.

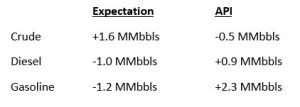

The API’s data last night:

The API reported a small draw of 0.5 MMbbls versus an expected build of 1.6 MMbbls. At Cushing, stocks fell for the first time in seven weeks with a draw of 1.2 MMbbls. Products experienced builds with distillates and gasoline both experiencing a build vs. an expected draw. The crude market is up in early trading Thursday in anticipation of EIA data coming out later this morning.

In news from Asia, Chinese refineries processed 13.68 mmbpd of crude in October, according to Bloomberg calculations based on data from the National Bureau of Statistics and oil demand rose 7.3% to 13.02 mmbpd. Demand for chemicals in Asia is increasing around 2 times quicker than for fuel, said Abdulaziz Al-Judaimi, Saudi Aramco’s senior vice president for downstream; Aramco now wants to develop a refinery in China that produces more chemicals than refined fuels.

This article is part of Crude

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.