Strikes, Storms, and Storage Reports

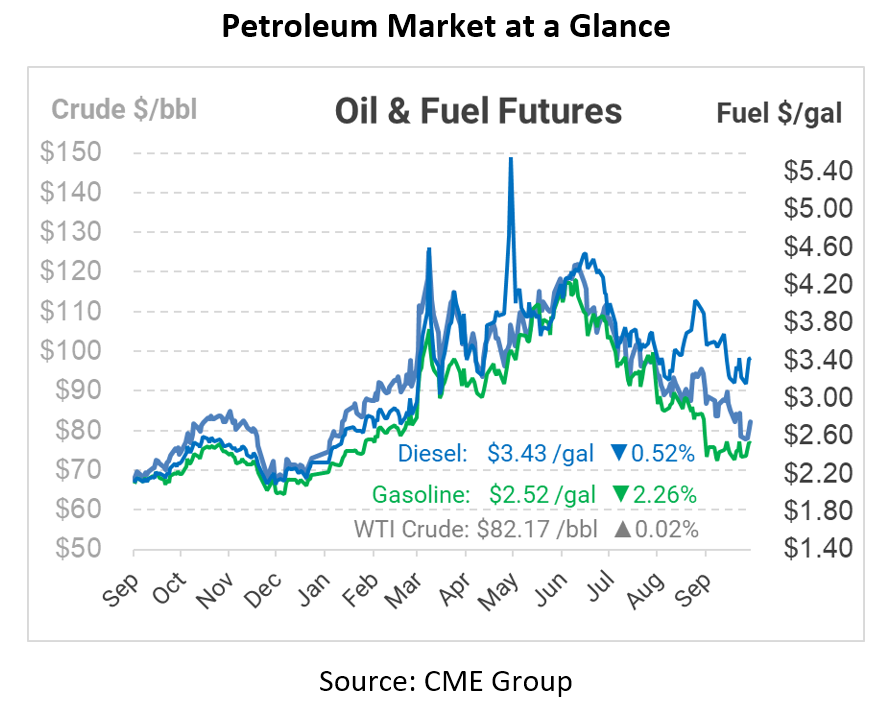

Fuel markets shot higher yesterday following the EIA’s report, which showed declining inventories and declining refining activity. Hurricane Ian made landfall in Florida yesterday, bringing devastation for fuel markets in the center of the state. In France, labor strikes have shut off a large chunk of refining capacity, with winter just a few months away. Last, the US Dollar has fallen significantly over the past few days, but remains near record highs. Let’s unpack today’s news.

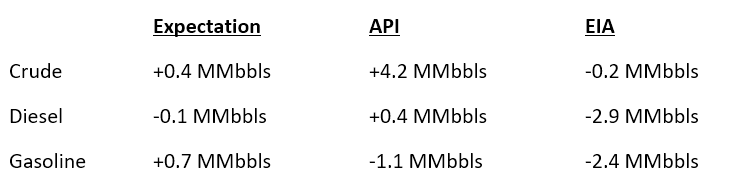

The EIA released their weekly inventory report yesterday, which showed an across-the-board draw from petroleum inventories. Although market expectations, and even the weekly American Petroleum Institute estimate, had shown an overall increase in stocks, the EIA reported that both diesel and gasoline fell by more than 2 million barrels last week. US refinery utilization fell 3% to 90.3% total, which explains some of the drop in product inventories. Demand also picked up, rising from last week’s seasonally low numbers.

In Florida, Hurricane Ian made landfall yesterday with wind speeds of 155 mph, making it the fifth-strongest storm ever to hit the US mainlands. Over 2 million are without power now in central Florida, and fuel supplies are extremely tight. For the latest news on Hurricane Ian, check out Mansfield’s latest updates here: https://mansfield.energy/market-news/tag/hurricane-ian/

In France, labor strikes have impacted production at five refineries, shuttering roughly 60% of France’s refining capacity – 740,000 barrels per day (31 million gallons per day). The strikes come as Europe faces an oil crisis due to pending embargos on Russia. The French government had asked companies to replenish oil inventories, which were drawn down earlier this year in coordination with global emergency stockpile releases. With winter just around the corner, the lost output could cause major challenges as heating demand ramps up, especially with Russian embargoes on refined products going into effect in February.

In macro market news, the US Dollar has declined a bit from multi-decade highs, but remains elevated. The record high USD has created headwinds for oil prices, since the two are inversely correlated. With the dollar seeing some weakening over the past few days, oil markets have had a bit more room to mount a rally, leading to yesterday’s uptick that saw US crude prices exceed $80/bbl once again.

This article is part of Daily Market News & Insights

Tagged: EIA Inventories, France, Hurricane Ian, Labor Strike, Refineries, US Dollar

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.