Storm Alert Update – Pt Everglades Terminals Will Close Ahead of Irma’s Impact

The latest models show Hurricane hitting the center of Florida as a Category 4 hurricane and tracking directly through the middle of the state. With a diameter of roughly 400 miles, Irma will impact both sides of the state, though the east coast will be the most heavily impacted as the storm’s rotation pummels the coast with wind and storm surge.

The fuel situation is extremely tight in Florida. Retail gas stations are reporting outages throughout the state, including 40% of all stations in Miami and 35% of stations in Tampa. Orlando (33%), Jacksonville (23%), and Tallahassee (25%) are also experience retail gas shortages. Florida Governor Rick Scott has urged residents to “[t]ake only the fuel you need” to ensure sufficient fuel is left for evacuees and first responders.

Terminals in Pt Everglades will be shutting down this afternoon ahead of storm damage, as most residents have already evacuated the South Florida area. Terminals throughout Florida, including Jacksonville, Tampa, and Cape Canaveral, have announced plans to close as the storm approaches. As terminals close down, carrier capacity often does as well, making deliveries in South Florida and other areas extremely difficult over the next few days.

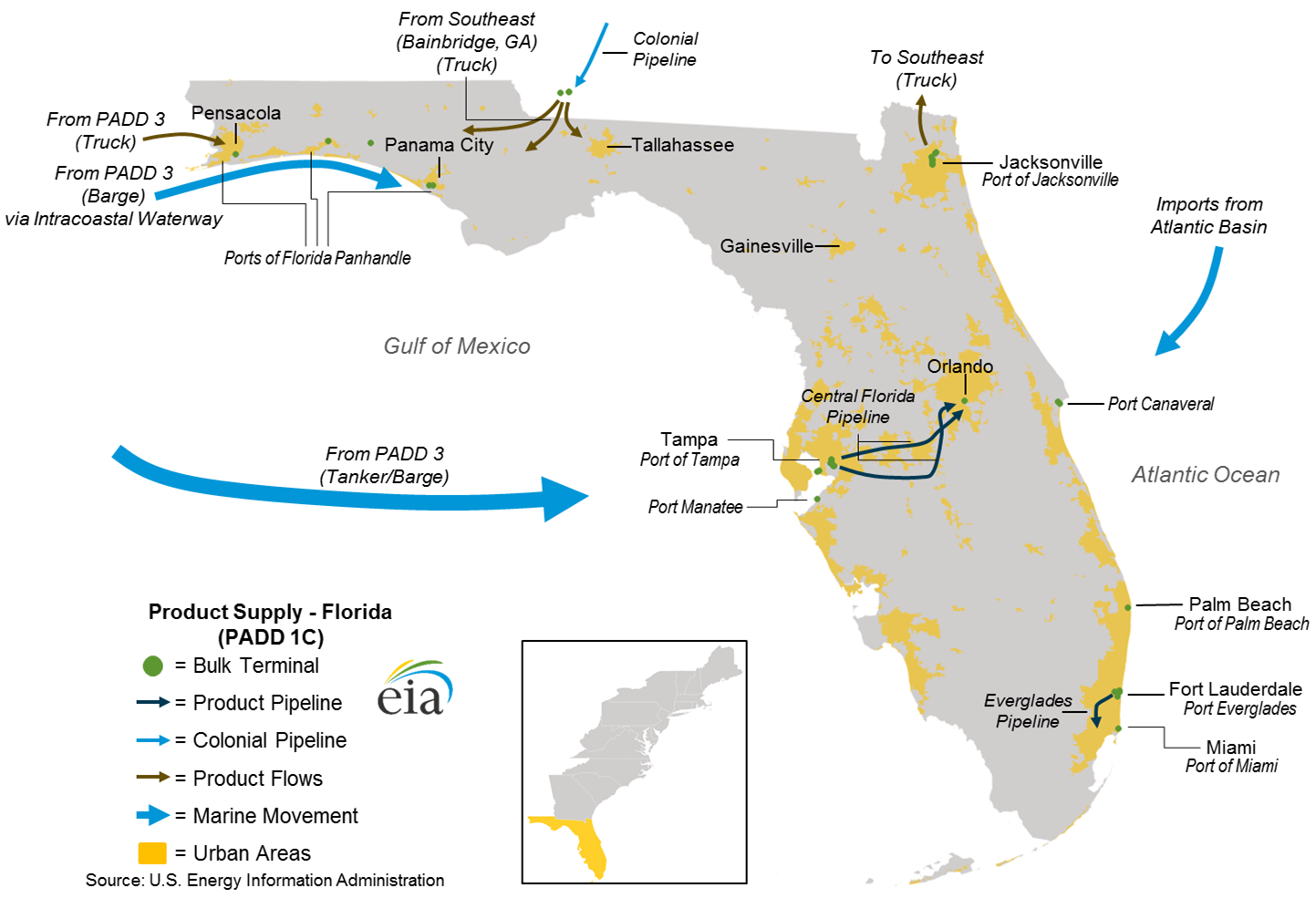

Florida has a unique fueling infrastructure – virtually all of the product coming into the state comes by barge. The Colonial Pipeline feeds some northern markets (Tallahassee, Panama City, etc), but Jacksonville, Miami, and Tampa all rely on barge supply. It’s noteworthy, then, that all of South Florida’s ports have been set to port condition Yankee, meaning no incoming vessels and all large vessels must leave dock. Those ports will move to Code Zulu, meaning no activity at all, at 8pm tonight. At the same time, Port Canaveral and Tampa Bay have moved to Yankee or will move soon, preventing any new supplies from coming into the market. This will put pressure on supply until after Irma passes, likely Saturday evening or Sunday.

Today the U.S. Department of Homeland Security issued a Jones Act waiver to help improve supply in Florida. The Jones Act requires that for all fuel delivered from a U.S. port to a U.S. port, the ship must fly a U.S. flag and be staffed by a U.S. crew. The waiver allows non-U.S. ships to deliver fuel to ports in Florida. While this will not alleviate the carrier capacity concern being experienced state-wide, it will at least help keep supply flowing into the area after Irma passes through.

Texas Market Updates

- Dallas: Diesel improving daily (Magellan in good shape), gas still a bit tight, Irving expected to reopen this weekend. Carrier capacity still impacting deliveries.

- Houston/Pasadena: Moved to Code Orange for diesel, however, we are still at Code Red for gasoline. Carrier capacity still impacting deliveries.

- San Antonio: Citgo terminal outage until late Friday at best. Resupply delayed until Sept 12 (a three day delay)

- Corpus: Diesel remains in good shape. Carrier capacity remains an issue into San Antonio and South Texas (Edinburg, Harlingen, and Brownsville).

- El Paso/West Texas: Code Red due to no rack supply available. Long hauls coming from other markets

- Waco: new Code Red status due to shortages, expected to be the last area in TX to catch up.

Southeast Market Update

Pre-Irma landfall heavily impacting Southeast coastal areas as well as general carrier capacity. Overall, we see general demand way up: top-offs and requesting more working inventory than usual is impacting resources. Will need to continue prioritize low level tanks. Local diesel: anticipate long hauls from most Southeast markets south after Irma passes. Pipeline shipments remain intermittent, making supply unreliable.

Florida Market Update

Outages throughout the state. Reports show a high percentage of retail gas stations with no fuel due to high demand from evacuees and supply shortages.

- Miami/Port Everglades: Terminals closing today late afternoon. Local carriers will be unavailable and most will evacuate.

- Tampa: Main source of supply for Florida. Terminals remain open, though supply is tight. Where supply is available, lines are lasting 4-6 hours. Tampa Bay/St Petersburg port closing tonight at 8pm, shutting off supply until the port can reopen.

- Orlando: Supply originates in Tampa, so linked to that market. Gasoline coming back online after outage this morning.

- Jacksonville: Terminals shutting tonight or tomorrow. Expect power outages and offline ports to affect supply following the storm.

Market Summary

Mansfield continues to work around the clock to help our customers fuel during the storm. If you have any questions or need to secure supply in the Gulf, Southeast, or in Florida, please reach out to your sales rep or customer relationship manager for more information about ordering product. Please place orders 48-72 hours in advance whenever possible, to allow time to secure supply and freight during the shortage.

Code Red (Areas with significantly reduced or unavailable supply)

- Austin, TX

- Beaumont, TX

- Buda, TX

- Dallas/Ft Worth, TX

- El Paso, TX

- Houston, TX

- Port Arthur, TX

- San Antonio, TX

- Waco, TX

- Southeast States (Mississippi through Maryland)

- Florida

Code Orange (Areas with limited supply availability)

- Corpus Christi, TX

- Edinburgh, TX

- Harlingen, TX

- Odessa, TX

- Lake Charles, LA

- Baton Rouge, LA

This article is part of Alerts

Tagged: fuel, hurricane, Irma, Miami, Pt Everglades, south Florida

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.