Stock Up on Avocados – Mexico Tariffs Announced by Trump

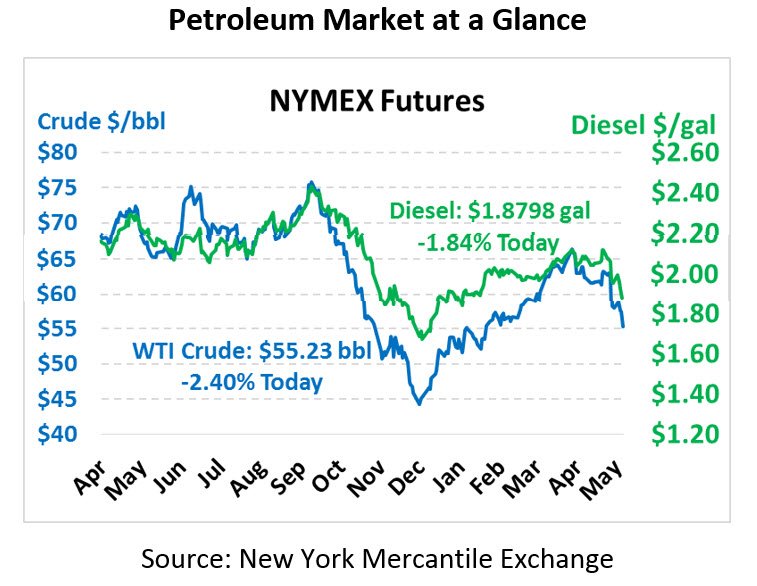

Oil is plummeting once again, with both gasoline and diesel trading below $1.90. The recent dip in prices has sent many fuel consumers rushing to lock in fixed forward prices, given volatility and uncertainty regarding whether prices will rise or fall. This morning crude is trading at $55.23, down $1.36 (-2.4%) to its lowest level since February.

Crude losses are dragging fuel prices along for the ride, despite decent overall fuel demand this season. Diesel prices shed another 3.5 cents (-1.8%), trading at $1.8798 which is the lowest price since January. Gasoline prices are $1.9284, down 4.9 cents (-2.6%).

Driving prices lower today, Trump announced plans to impose a 5% tariffs – increasing another 5% each month until it reaches 25% – on Mexican goods until the country fixes immigration concerns at the US-Mexico border. Mexico is America’s second largest trade partner after China, sending large quantities of manufactured goods and electronics (if you’re a Millennial, they also supply nearly 80% of America’s avocados). Oddly, the announcement came right as Trump lifted steel and aluminum tariffs on Mexico and Canada in an effort to finalize the USMCA, the trade deal meant to replace NAFTA. Many believe the new tariffs will put a wrench in USMCA negotiations, potentially delaying them until after the 2020 elections.

From a fuel standpoint, all signs point to tariffs applying to crude oil as well. The US imports 680 kbpd of Mexican crude, which would now be more expensive, reducing refiner profit margins. But the overall economic affect and weakened fuel demand more than offset the small price increase of one country’s supply, leading to the hefty sell-off we’ve seen this morning in oil and other financial markets.

Midwest Flooding Disrupts Fuel Supplies

In news a bit further north, the US Midwest has been struggling with flooding for some time, with severe effects on refinery activity. While the 350 kbpd Ozark pipeline returned to full capacity after spending time offline, some other crude pipelines in the Midwest remain below full capacity, creating constraints for refineries. Additionally, roughly 300 kbpd of PADD 2 Midwest refineries are offline due to flooding along the Arkansas and Mississippi Rivers. PADD 2 refinery utilization remains well below the rest of the US – while the national average utilization rate was 91.2%, PADD 2 is refining at just 84.2% of capacity.

The flooding has had a stronger impact on gasoline than diesel. While diesel basis in Group 3 and Chicago remain roughly within historical levels, Chicago gasoline basis has risen to its highest level in two years. Still, the gasoline price gains are not outside the norm for the volatile Chicago region, where prices swelled to trade $1/gal over NYMEX back in August 2015.

In addition to flooding, tornadoes in the Ohio region have impacted fuel terminals, causing disruptions earlier this week at the Dayton terminal. Power outages affects a large area, with thousands of homes and business offline. Diesel and gas supplies were both affected in the broader OH area as a few suppliers temporarily shut off rack supply.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.