State of the Union – What Was Said

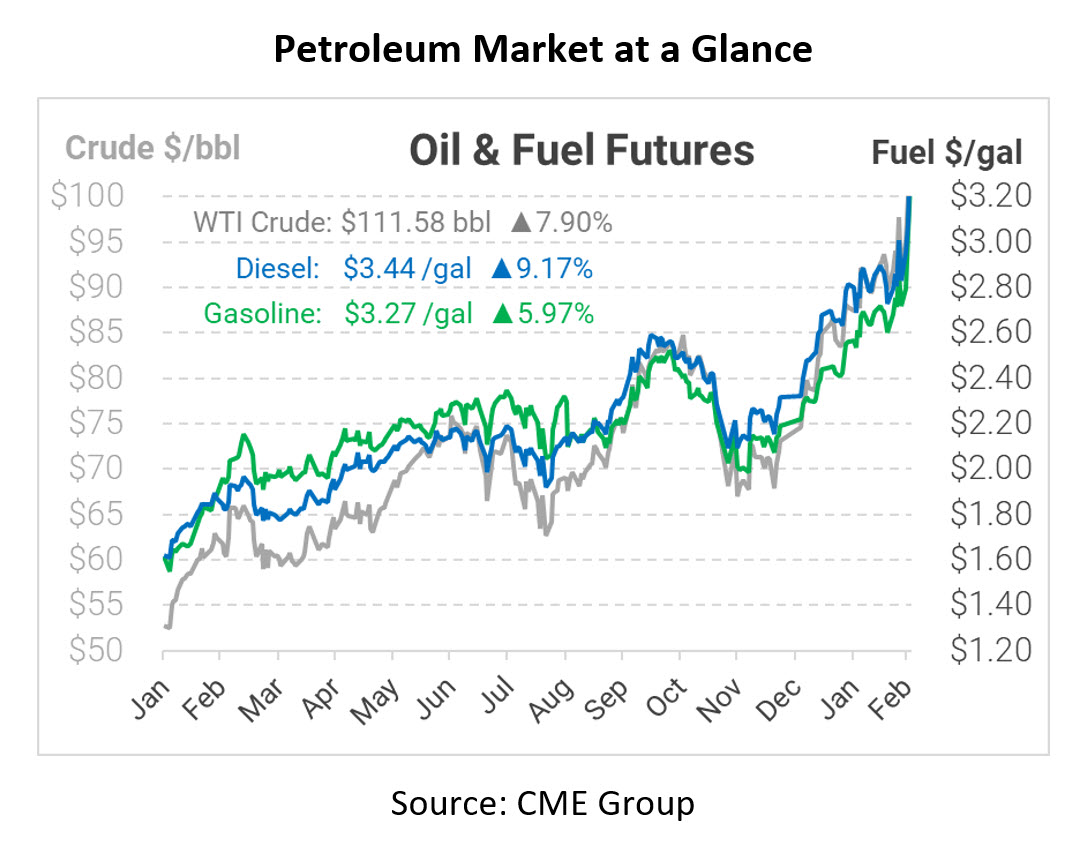

During yesterday’s State of the Union address, President Biden addressed many key topics during a time when tensions are spiraling in the east. The oil conflict with Russia and Ukraine was a priority, and Biden’s address came at a critical moment as oil prices have jumped 11% to 7-year highs this morning.

The President announced that the U.S., together with the International Energy Agency, would release another 60 million barrels of crude oil from various global reserves. This total number includes 30 million from the United States. This big of a release has not happened since 2011, when supply disruptions in Libya and other countries had a severe impact on global economies. Past releases from the U.S. reserves have had little impact on prices, so few expect a big change for oil prices. Analysts remain adamant that the only way to change the course of rising prices is to put more pressure on OPEC+, which has not deviated from their original output plan.

Per the International Energy Agency, 60 million barrels is around 4% of the total 1.5 billion barrels of stockpile that the agency has reserved for emergencies. “The situation in energy markets is very serious and demands our full attention,” said IEA executive director Fatih Birol. “Global energy security is under threat, putting the world economy at risk during a fragile stage of the recovery.” The 60-million-barrel release only equates to around 6 days of Russian oil production or 12 days of Russian exports. While the impact may not be as significant as people were expecting, Biden remains firmly situated in his stance to isolate Russia and their economy from the rest of the world, and until then the United States and allies will find their own ways to combat supply chain problems as it relates to energy.

Aside from the Russian-Ukrainian conflict that has taken center stage, Biden also addressed the critical topic of inflation last night. According to Biden, to combat rising inflation he is asking corporations to “Lower your costs, not your wages.” Instead of relying on foreign supply chains, he wants to jumpstart domestic production of cars, semiconductors, and other goods. Inflation has been an extremely tough problem for Biden to tackle since taking office. On February 16, the Labor Department reported that the consumer price index rose 7.5 percent over the previous 12 months, more than any one-year period since 1982. Even more cause for concern was that energy was up at 27%. This idea of “buy American” dates back nearly a century, but it’s unclear if or when these policies will make a dent in spiraling inflation.

Biden also talked about increased investments in infrastructure and innovation, as well as better paying jobs that raise the minimum wage to $15/hour. “Now our infrastructure is ranked 13th in the world. We won’t be able to compete for the jobs of the 21st Century if we don’t fix that,” said Biden. Since failing to get his Build Back Better package passed through the Senate last year, the president is under immense pressure to figure out the inflation problem before it spirals out of control. This $1.75 trillion economic and climate package was one of Biden’s primary campaign pieces, but since his inauguration nothing has come from it. The State of the Union provided some much needed clarity on the specific next steps the U.S. was taking to address the conflict in Ukraine, but also showed the country where exactly the president plans to go with his idea of lowering costs and protecting the American economy.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.