Silicon Valley Bank Failure – What Does It Mean for Fuel Prices?

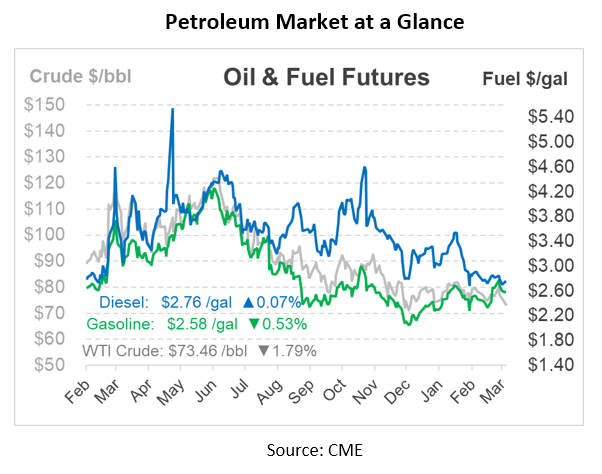

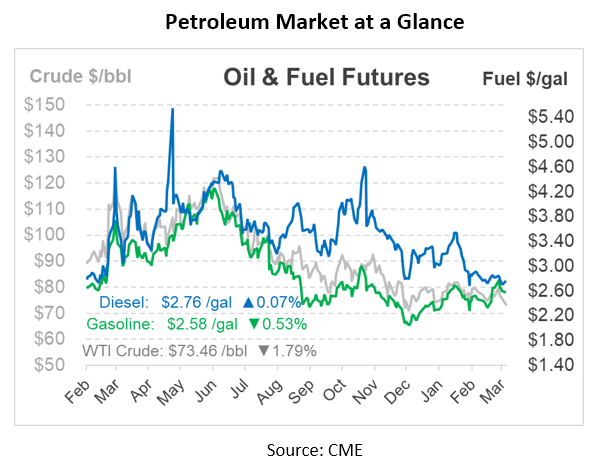

In the face of the Silicon Valley Bank failure, fuel prices are a bit lower but have also shown a bit more strength than crude oil. Crude oil is trading near the bottom of its recent trading range, slumping to $73/bbl after two days of losses. Uncertainty about the SVB bank closure, mixed with surprising Alaska oil permits from the Biden administration, are sending oil prices tumbling to start this week.

Oil markets have experienced spillover uncertainty due to concerns over the US’s financial stability. The 16th largest U.S. bank, Silicon Valley Bank, was shut down by federal regulators when it became unable to fulfill customer withdrawal requests due to a panic-driven liquidity crunch. US authorities also shut down a second regional bank, New York’s Signature Bank. Although these bank closures have no direct impact on oil supply or demand, they do pose a risk to economic stability and are therefore being treated as bearish.

Due to the two banks’ failures, the Federal Reserve and the US government were compelled to offer a safety net to ensure depositor access to their money. While headlines claim this is the “biggest bank failure since 2008”, analysts predict the fire will not spread to other banks. President Biden attempted to portray calm yesterday morning by stating that the country’s financial systems were secure. As the second-largest bank failure in American history, Silicon Valley Bank’s demise had regulators rushing over the weekend to prevent any potential contagion. Volatility is inevitable, and concerns are justified because this quickly growing development is still in its early stages. The overall economy is still stable, although lending rates are likely to tighten to some extent. We might also recognize some impact of the financial burden on consumer and business sentiment.

Although the short-term effects could be bearish, the medium- and long-term effect on oil prices could be more bearish due to the Silicon Valley Bank demise. Goldman Sachs now anticipates no further hikes in light of the banking system’s stress. Higher interest rates cause oil demand (and therefore prices) to fall, so the Federal Reserve pausing their rate hikes could mean higher oil demand than previously expected. US CPI data will be released later today, which will also provide data for the Fed to consider as it meets later in March.

The Biden administration is also speaking out regarding the highly contentious Willow oil project that was approved yesterday. This project, opposed by environmentalists and promoted by the oil industry, would allow ConocoPhillips Co. to drill under federal leases in the North Slope of Alaska. Domestic oil production in the US could increase by 180,000 b/d with the $8 billion oil drilling project.

Biden’s decision demonstrates the challenges faced by the government as the gravity of climate change clashes with the realities of the Russian-Ukraine war, combined with the volatility it all brings about in the world’s energy markets. In his State of the Union, Biden admitted that oil and gas would be needed for the next decade at least, and now his administration seems to be opening up drilling options. It seems the White House is prioritizing energy security over climate activism, at least for now, which could give oil companies more business confidence to invest in long-term drilling and refining projects.

This article is part of Daily Market News & Insights

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.