Short-Term Energy Outlook – September

Editor’s Note: Each month, the EIA produces a publication called the Short-Term Energy Outlook, which analyzes oil, fuel, natural gas, and power markets and gives projections into the future. Click Here to read the EIA’s full STEO report.

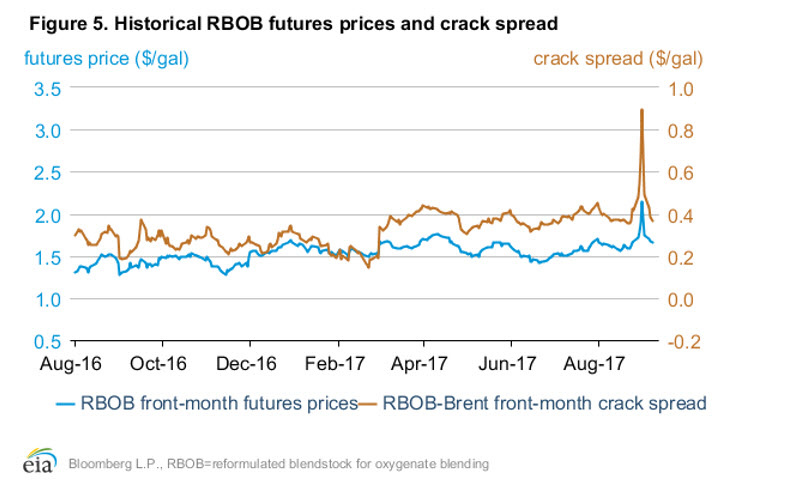

Gasoline prices: The front-month futures price of reformulated blendstock for oxygenate blending (RBOB, the petroleum component of gasoline used in many parts of the country) was unchanged from August 1, settling at $1.66 per gallon (gal) on September 7 (Figure 5). The RBOB-Brent crack spread (the difference between the price of RBOB and the price of Brent crude oil) declined 6 cents/gal over the same period, settling at 36 cents/gal. EIA compares RBOB prices to Brent prices because EIA research indicates U.S. gasoline prices move with Brent prices.

Landfall of Hurricane Harvey in late August closed several refineries on the U.S. Gulf Coast and damaged petroleum-related infrastructure, creating considerable uncertainty for gasoline supply and demand and contributing to large price increases. Moreover, reduced open interest in September RBOB futures contracts near expiration at the end of August likely added to increased price volatility. On September 1, the RBOB front-month futures price declined as the October RBOB front-month futures contract became the active contract, which reflects wintergrade gasoline that is cheaper for refineries to produce. However, the October RBOB futures contract rose 23 cents/gal from August 1 to August 31, suggesting the effects of the hurricane on the gasoline market may last into October.

The Colonial pipeline, a 2.5-million-b/d pipeline that typically runs at full capacity supplying petroleum products from the U.S. Gulf Coast to the U.S. East Coast, was forced to run intermittently following the storm because of decreased supplies available for shipping. Refineries in the Gulf Coast began restarting during the week of September 4, and continuous operations on the Colonial pipeline were restored, albeit at reduced rates, on September 6. However, it remains unclear when the pipeline will resume normal operations.

Ultra-low sulfur diesel prices: The ultra-low sulfur diesel (ULSD) futures price rose 14 cents/gal since August 1, settling at $1.79/gal on September 7. The ULSD-Brent crack spread (the difference between the price of ULSD and the price of Brent crude oil) rose by 8 cents/gal, settling at 49 cents/gal (Figure 6).

ULSD prices and crack spreads also increased because of uncertainty surrounding Hurricane Harvey’s effects on refined product supplies. The shutdowns of the export facilities along the Houston Ship Channel, among other areas, likely affected international distillate markets, as the U.S. Gulf Coast accounts for nearly 90% of U.S. distillate exports. Several ports along the Gulf Coast began to reopen the week of September 4 with certain draft restrictions. Future port utilization and exports will depend on the pace of recovery from area refineries. Typical purchasers of U.S. distillate-including Mexico, Brazil, and the Netherlands-will likely have to seek other sources of supply until U.S. distillate exports resume.

RBOB and ULSD futures curves: The refinery outages from Hurricane Harvey reduced U.S. Gulf Coast refinery production of gasoline and distillate by about 36% and 24%, respectively, from the week of August 25 to September 1. The outages placed a significant pull on gasoline and distillate inventories, which is reflected in the shape of the futures curves for RBOB and ULSD. The RBOB 1st-13th spread closed at the highest level in nearly five years on August 31, settling at 50 cents/gal, whereas the ULSD 1st-13th spread closed at 10 cents/gal, the highest since February 2015 (Figure 7). The RBOB 1st-13th spread fell by 28 cents/gal on September 1, as the October contract became the front-month contract. The ULSD 1st-13th spread fell by 2 cents/gal on September 1, as the October contract became the front-month contract. The falling spreads for the October contracts indicate the market expects some easing of the supply situation by October.

On a days-of-supply basis, total U.S. gasoline and distillate inventories were lower by 0.3 days and 5.4 days, respectively, in the week before hurricane landfall (August 25) compared with the days of supply at the end of August 2016, according to EIA’s Petroleum Supply Monthly. The increase in front-month prices compared to longer-dated prices typically occurs during supply disruptions, when inventory drawdowns are needed to meet demand.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.