Saudi Supply Cuts Boost Market

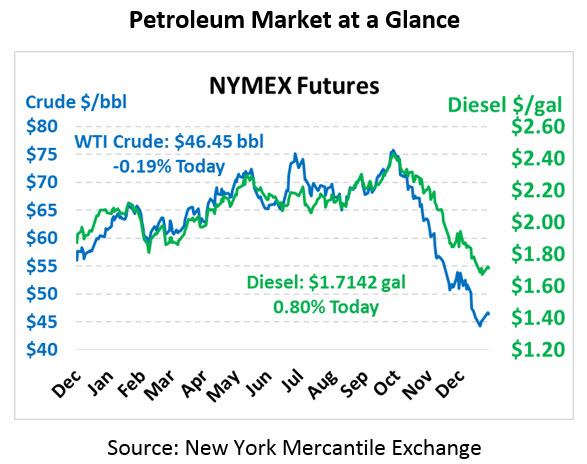

Yesterday saw a wide trading range for the oil complex – products fell in the early morning, soared higher mid-morning, and settled with some mild gains by the end of the afternoon. Crude is currently trading at $46.45 this morning, roughly flat after gaining over $1.00/bbl yesterday.

Fuel prices saw similar volatility yesterday, with both diesel and gasoline prices sporting 10-cent ranges from low to high yesterday. Despite the large range, diesel ended with 2 cent gains, while gasoline was virtually unmoved. Today, diesel prices are trading at $1.7142, up 1.4 cents from yesterday’s close. Gasoline prices are $1.3344, up 0.9 cents.

Yesterday’s rally was stimulated by a report showing Saudi Arabia’s output fell by 400-500 kbpd in December – exactly what they promised in November. Although the supply cut was expected, it does prove that Saudi Arabia is serious about their commitment to balancing markets.

Adding to supply concerns were reports from Libya of further damage to El-Sharara oil field, which normally produces 315 kbpd but has been under force majeure since mid-December. Officials noted an additional output loss due to looting and operational equipment losses. Altogether, OPEC output fell by some 400-500 kbpd in December (depending on which survey you’re looking at), with the cuts partially offset by production increases in Iraq, Nigeria, and Kuwait.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.