Saudi Arabia on Track for Fast Recovery

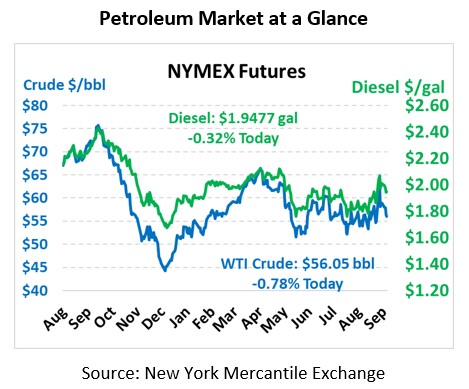

News of Saudi production coming back on line and inventory builds drove markets lower yesterday and today. WTI Crude is trading at $56.05, a loss of 44 cents.

Fuel is flat this morning. Diesel is trading at $1.9477, a loss of 0.6 cents. Gasoline is trading at $1.6310, a gain of 0.6 cents.

Crude prices dropped 1% yesterday. News that Saudi Arabia was on track for a faster than expected recovery from recent attacks on oil infrastructure helped drive prices lower. It was reported that the Saudis had restored oil production capacity to 11.3 MMbpd from 5.6 MMbpd after the attack. In addition, inventory news of a surprise build helped to keep prices lower.

The EIA reported that stockpiles of crude and products rose across the board last week. At Cushing, API reports were confirmed by the EIA of the first crude build in 12 weeks. Gasoline was in line with expectations. Diesel saw a sizable build versus a small expected draw. The bearish news played out in the markets’ decline yesterday.

In China, the U.S. announced that there would be sanctions revolving around Iran to five individuals and six companies. The news curtails hopes of a prompt deal for the U.S.-China trade war.

This article is part of Crude

Tagged: API reports, attack, China, eia, Iran, Saudi Arabia, trade war, U.S.

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.