Saudi Arabia Cuts Output, Setting Stage for OPEC Action in December

Happy Veterans Day! Thank you to those who have served or are currently serving our nation’s armed forces, your sacrifice is appreciated.

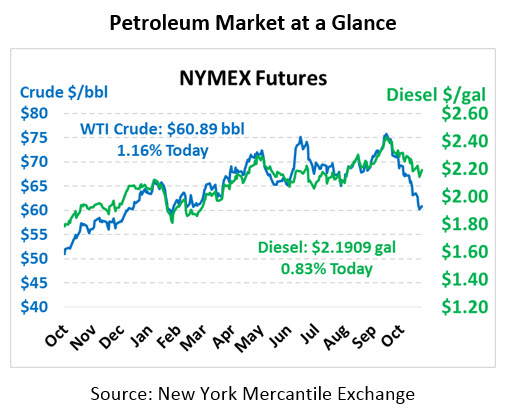

Despite dancing below $60 for part of the day on Friday, prices bounced higher to end the session at $60.19, still continuing a 10-day loss streak. Today, however, the losing streak looks like it’s come to an end. Crude oil prices are trading at $60.89 this morning, up 70 cents from yesterday’s close.

Fuel prices are also back in positive territory, though losses for the two products have not been proportional. For much of the summer, gasoline prices traded neck-and-neck with diesel, even exceeding diesel prices in July. Since then, diesel’s premium over gasoline has gradually expanded, hovering around 30-40 cents in October and on Friday reaching 55 cents. This morning diesel prices are trading at $2.1909, up 1.8 cents from Friday’s close. Gasoline prices are at $1.6440, up 2.3 cents.

This weekend, Saudi Arabia indicated Saudi output will be cut in December by half a million barrels per day compared to November – a clear indication that the group expects to maintain its swing producer role. After a slew of bearish news – including Iran sanction waivers, record high US production, and OPEC output hikes – markets were anxiously searching for the bulls to counter downward pressure. Expect OPEC chatter to be a key market driver ahead of their December meeting, when the group may vote to cut 2019 output by as much a 1 million barrels per day.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.