Sabotage attack damages two Saudi oil tankers, Iran calls the U.S. a “target”

Early market price action was decidedly higher on Monday following a pair of bullish geopolitical news stories. Tough rhetoric from Iran has become pretty common place over the last few months as sanctions take a toll on their oil production. However, over the weekend a senior Iranian Revolutionary Guards commander said that U.S. military forces in the Gulf have turned into “targets” rather than “threats”.

“An aircraft carrier that has at least 40 to 50 planes on it and 6,000 forces gathered within it was a serious threat for us in the past but now it is a target and the threats have switched to opportunities,” said Amirali Hajizadeh, head of the Guards’ aerospace division. “If (the Americans) make a move we will hit them in the head,” he added. Obviously, this type of talk will continue to keep oil markets on edge and add to the geopolitical premium that has already encapsulated the markets in recent weeks since the waivers for Iranian oil sanctions were removed.

The bigger piece of news that hit early this morning was an announcement by Saudi Arabia’s energy minister that two of its oil tankers had been struck by a sabotage attack off the coast of the United Arab Emirates (UAE). It was reported that the attacks caused significant damage to both vessels, but there were no causalities or news of an oil spill. Currently, no one has taken responsibility for the attacks, and the Saudis have yet to say who they suspect are behind the alleged sabotage. These unknowns will likely add to the already simmering geopolitical uncertainty in the region and keep markets well supported.

Tariffs, tariffs, and more tariffs

Equity markets continue to be held hostage by the back and forth chatter on tariffs between the U.S. and China. Last week’s price action saw big moves and intra-day price reversals as markets fluctuated greatly following tweets and retweets of tweets. The chaotic price action shows just how much the investment community is craving an end to the China-U.S. trade dispute. The bad news is that it looks like we are moving farther away from a trade agreement. The good news is that this could change at any time as the dispute tends to move on an hourly basis.

This morning, DOW futures dropped more than 400 points following tweets from President Trump blaming China’s President Xi Jingping for the trade deal falling apart last week. In a tweet storm this morning, Trump wrote, “you had a great deal…& you backed out”. On Friday, the U.S. hiked tariffs to 25% on $200 billion worth of Chinese goods. In response, China has threatened to retaliate with tariffs on U.S. goods. While it appears things are headed into a sinkhole, it would be wise not to underestimate the power of the “Trump put”. He tends to take a softer tone with China when stock markets head decidedly lower. Trump is very protective of the U.S. stock market and how deteriorating conditions can undermine his negotiating stance.

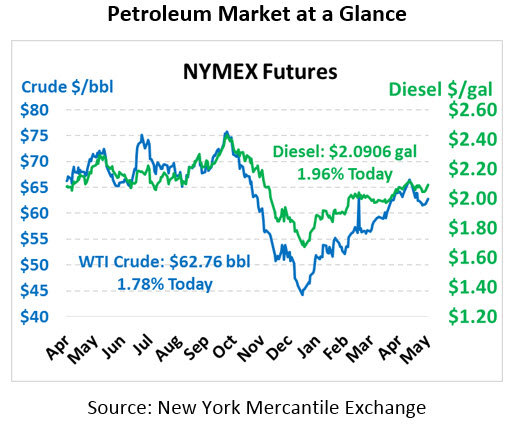

Crude oil is up more than $1 and trading near the $63 barrel handle. Refined products are each up about 4 cents respectively. The geopolitical news is definitely taking a priority over China-U.S. trade news this morning. We’ll see if it continues.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.