Russian President and Saudi King to Continue Cooperation

Working to lift markets this morning is the talk of supply cuts coming from OPEC+. Signs point to OPEC+ being willing to deepen cuts amidst the decreased demand caused by the coronavirus. OPEC+ is gathering for an urgent assessment of how Asia’s coronavirus may hurt oil demand; technical experts from the OPEC+ coalition will meet at the cartel’s Vienna headquarters to evaluate the disease’s impact.

Russian President Vladimir Putin and Saudi King Salman bin Abdulaziz spoke by phone and discussed the grim situation of the global hydrocarbon market, the Kremlin said in an emailed statement; both leaders confirmed their readiness to continue cooperation to keep the global oil market stable.

Crude is recovering most of yesterday’s losses this morning, but markets are still reeling from last week’s declines. Concern continues over the effects of the coronavirus on oil demand in China and Asia, but traders seem to have priced most of those concerns into the market already. The major remaining variable is how long will the crisis continue.

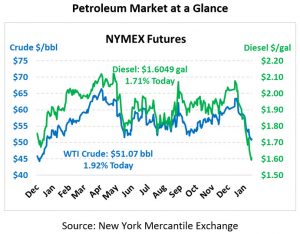

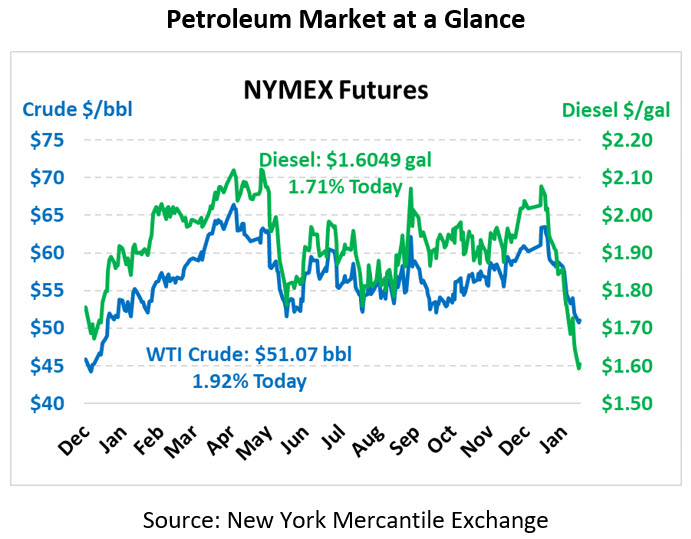

Crude prices are up this morning. Crude is currently trading at $51.07, a gain of 96 cents.

Fuel prices are up. Diesel is trading at $1.6049, a gain of 2.7 cents. Gasoline is trading at $1.4892, a gain of 1.6 cents.

This article is part of Crude

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.