Russian Oil Hedge – What It Could Mean for Consumers

On Wednesday, WTI Crude fought its way back from nearly $1/bbl down to finish the US session unchanged. In early trading this morning, crude prices are down slightly as investors consider the surprise increase in crude and diesel inventories.

Russian President Vladimir Putin gave his government the green light to consider hedging Russia’s oil and gas export revenues to protect the country from drops in prices. If adopted, Russia’s hedging program would be comparable to the Mexican oil hedge, using put options that would protect against falling prices while allowing for maximum profits as prices rise. This is not the first time Russia has considered an oil hedge; the country evaluated a similar deal in 2009 but opted against it.

Mexico is currently the only major oil producer to utilize hedging to protect oil revenues. Estimates show that Mexico spent $1 billion on the hedging instruments, and stands to earn $6 billion this year thanks to collapsing oil prices. The flood of options sales created by the “Mexico Hedge” would cause prices to decline if it occurred all at once or in the public eye; thus, it is a well protected secret until after the transactions have been completed.

With Russia considering a hedge, how might consumers be impacted? Russia produces roughly six times more crude than Mexico, though they may not choose to hedge every barrel. If they hedge a large portion and fail to keep it adequately confidential, the resulting drop in oil prices might create a good opportunity for fuel buyers to get on the other side of the trade and lock in low fuel prices.

More likely, the hedge will be kept quiet and won’t ripple noticeably through market prices. In this case, the main takeaway would be that Russia won’t have the same financial pressure to join the OPEC+ agreement, which is also bearish for markets. Either way you look at it, a well-hedged Russian oil sector could keep production high and prices low over the next year.

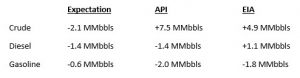

The EIA reported a surprise increase for crude of 4.9 MMbbls, versus an expected decrease of 2.1 MMbbls. At Cushing, the EIA reported that stocks rose by 1.4 MMbbls. US crude oil inventories are about 19% above the five-year average for this time of year. Distillates reported a surprise build and continue to trend roughly 27% above the five-year average. Gasoline reported a draw in stocks and is about 7% above the five-year average.

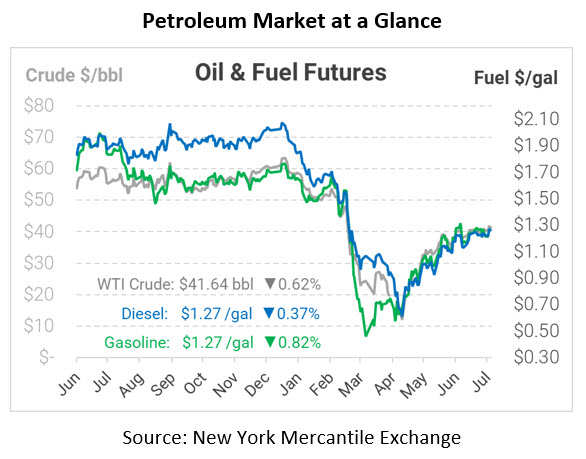

Crude prices are down this morning. WTI Crude is trading at $41.64, a loss of 26 cents.

Fuel is down in early trading this morning. Diesel is trading at $1.2660, a loss of 0.5 cents. Gasoline is trading at $1.2723, a loss of 1.1 cents.

This article is part of Daily Market News & Insights

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.