Russia-Ukraine Conflict: What’s the Impact on Our Oil Prices?

Tensions between Russia and Ukraine are heating up, with major world leaders saying a Russian invasion is coming. For many years, Russia has seen Ukraine has an opportunity for expansion, believing it is part of their social and economic area of interest that they should tap into. In 2014, Russia annexed the Crimea peninsula, which they claimed was done to support the local ethnically Russian population. Now with 100,000 Russian troops stationed on the border of Ukraine, people are starting to fear that invasion is a real possibility. But what does this have to do with fuel?

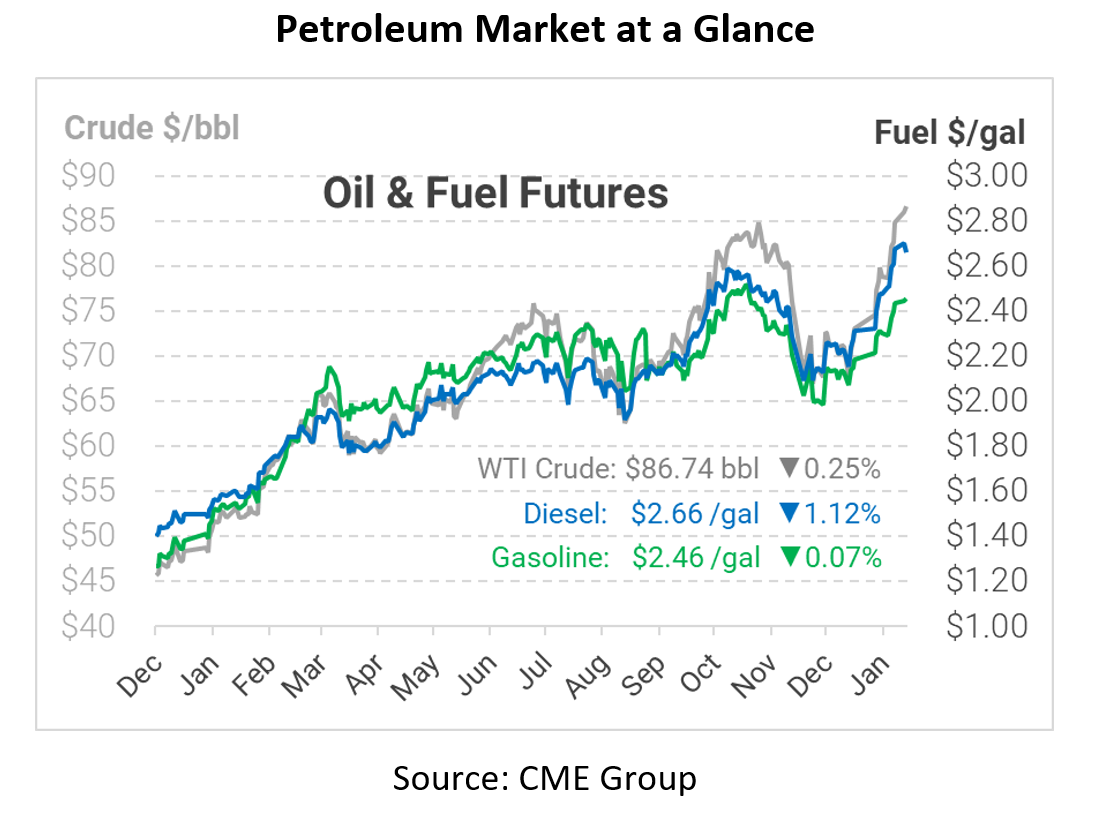

This week we have seen oil prices spike to a seven-year high, and with instability in the Middle East flaring, a Russia-Ukraine conflict may feel like just another problem in the mix. As the world’s number two oil producer (behind the United States), Russia’s influence on world oil is sometimes forgotten. Currently, the United States imports around 600-800 kbpd of oil from Russia, but that might all change if a Ukraine invasion were to happen. The Biden administration has recently stated that Putin would “pay a serious and dear price for it” if he were to invade Ukraine.

One possible outcome from a Russian invasion of Ukraine would be immediate sanctions on Russia’s vast energy resources, and that could be reflected in what we pay at gas stations. And if the US chooses to directly defend Ukraine, there could be an open conflict between the world’s two largest oil producers. Tensions are high, and it’s impossible to predict how all actors might respond. If the US does impose sanctions comparable to Iran sanctions, they could try to coordinate it with a major uptick in OPEC production to soften the blow. But OPEC has already been struggling to increase output, so they may not be able to keep up.

In the event of sanctions – or worse, an open conflict between the US and Russia – we do not know how high prices could go or how long they would stay that way. With everything we have seen over the past two years, though, it seems possible that market fear alone could propel prices over $100, before any real consequences hit the market.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.