Rising Rigs Restore Rally

Rising rig counts and storms brewing in the Gulf of Mexico are giving markets a lift this morning. Reuters reports 58% of Gulf output – over 1 MMbpd – is offline as the storms approach. With both storms hitting the Gulf Coast in a few days, the output loss could materially impact next week’s crude inventory report. Already trending lower, crude inventories may see an incremental 4-5 million barrels withdrawn if storms keep Gulf Coast rigs offline until Thursday.

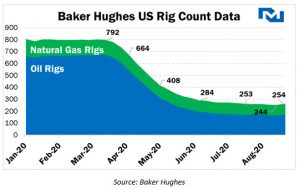

Friday’s Baker Hughes data proved supportive for markets, as stabilizing oil prices have finally enabled producers to begin the long, slow process of reinstating production. Oil rigs rose by 11 rigs last week, the largest build since January. Ten of those rigs were brought back in the Permian Basin, which has some of the best drilling economics in the US. Overall rig counts (including oil and gas rigs) increased by 10 rigs, the first gain of any size since March. WTI crude has been persistently above $40/bbl since July, and after two months, producers seem more confident that they can take advantage of the increase.

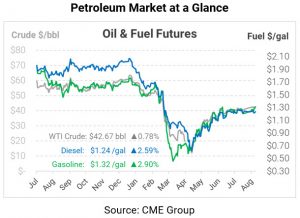

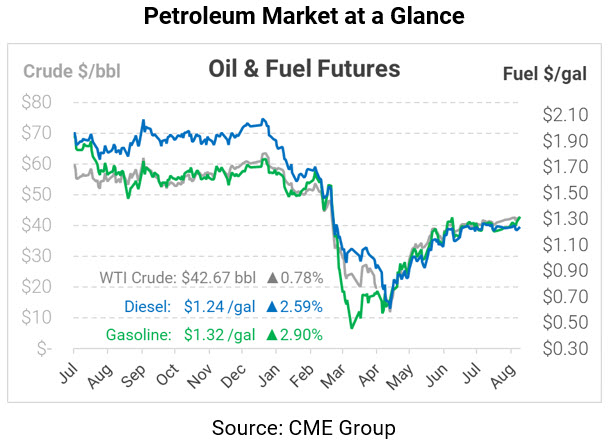

The oil complex is rising this morning, with both WTI and Brent crude posting solid gains. WTI Crude is trading at $42.67, up 33 cents (0.8%) above Friday’s closing price. Brent is just $2.10 above WTI, posting nearly 1% gains.

Fuel prices are also seeing a lift this morning as traders “buy the rumor and sell the news” ahead of the storm. Both storms are set to make landfall near America’s refining hub between Houston and Louisiana, so there’s (relatively small) potential for refinery disruptions this week. As such, diesel is currently trading at $1.2393, up 3.1 cents (2.6%). Gasoline, which has performed strongly over the past week, is $1.3214, up 3.7 cents (2.9%).

This article is part of Daily Market News & Insights

Tagged: Baker Hughes, Rig Counts, tropical storm

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.