Rising Infections, Falling Market

On Wednesday, WTI crude followed US equities lower on a host of bearish news. Losses continue this morning on failing confidence of economic recovery due to a resurgence on coronavirus cases in the US and Europe.

France and Germany are instituting a second wave of lockdowns to stem the rising tide of infections in their countries. France will impose a nationwide lockdown for at least a month. President Emmanuel Macron stated that officials had no choice but to impose another lockdown and that all of Europe could be, “overwhelmed by a second wave that we now know will probably be harder and more deadly than the first.” Germany will close bars and restaurants along with other restrictions in an effort to keep hospitals from becoming overwhelmed with infected patients. “We must act, and act now, to prevent a national health crisis,” Chancellor Angela Merkel said.

In the US, the governor of Illinois has ordered Chicago to close indoor dining at bars and restaurants to curb rising coronavirus infection rates. Across the US, infections are rapidly accelerating with an average of 72,000 new cases per day. Experts expect new restrictions to go into effect around the US should these infection rates persist over the next few weeks.

The EIA reported an increase for crude of 4.3 MMbbls, compared to an expected increase of 1.2 MMbbls. At Cushing, the EIA reported that stocks decreased by 0.4 MMbbls. US crude oil inventories are about 9% above the five-year average for this time of year. Distillates reported a draw and continue to trend roughly 17% above the five-year average. Gasoline inventories had a draw and are about 3% above the five-year average.

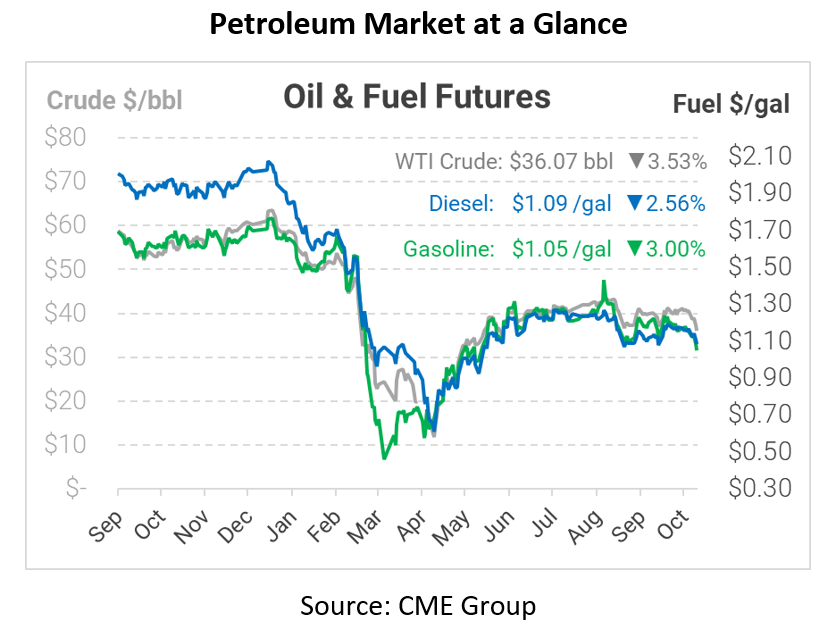

Crude prices are down this morning. WTI Crude is trading at $36.07, a loss of $1.32.

Fuel is down in early trading this morning. Diesel is trading at $1.0857, a loss of 2.9 cents. Gasoline is trading at $1.0490, a decrease of 3.2 cents.

This article is part of Daily Market News & Insights

Tagged: crude, diesel, economic recovery, eia, France, gasoline, Germany, nationwide lockdown

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.