Revisiting Old Trends – What’s Up with China & Iran?

With so many COVID headlines in the media, occassionally it’s helpful to look back at the trends that were “supposed” to become the dominant theme of 2020. For oil markets, the two largest headlines were the US-China Trade Deal and rising malcontent between the US and Iran. What’s new in those fronts?

China

In January, many thought the escalating trade war between the US and China would dominate global headlines throughout 2020. Then, markets received a huge boost when the two countries signed the Phase One trade deal to hault mounting tariffs.

Since then, China has been on the hook to increase its purchases of American products; however, a global pandemic and the worst global depression since World War II have thrown a wrench in those plans. Year-to-date Energy, Agriculture, and Manufactured Goods purchases are all significantly behind the levels set forward in the agreement

A six-month compliance review scheduled for Saturday has now been postponed, with officials citing a scheduling conflict. While officials have noted that the delay is not a reflection of fractions in the deal, many wonder whether the postponement is actually related to giving China more time to up their purchases. So far, the Trump administration has been satisfied with China’s recent purchases, even though the country is well behind quotas. With the global economy in shambles, both sides are playing nice; any signs of discontent from either side would send piercing alarms throughout equities and commodities.

Iran

Last week, the US seized 1.1 million barrels (46 million gallons) of fuel, claiming the fuel was being shipped from Iran to Venezuela. The Greek owners of the vessels allowed US forces to board the ships without military conflict, minimizing the diplomatic consequences of the action. Iran denies that the fuel belonged to them originally. Funds from the sale of the seized fuel could go to a Jutice Department fund for victims of state-sponsored terrorism. In retaliation, Iran boarded a Liberian oil tanker presumably as a show of force, though they quickly released the ship afterwards.

Today’s Trends

Markets are closely watching Southeast fuel supplies. The Colonial Pipeline, which supplies the vast majority of fuel from the Gulf Coast to East Coast markets, reported a gasoline leak just north of Charlotte, NC. While product continues flowing to SC, the pipeline further north is offline until repairs can be made.

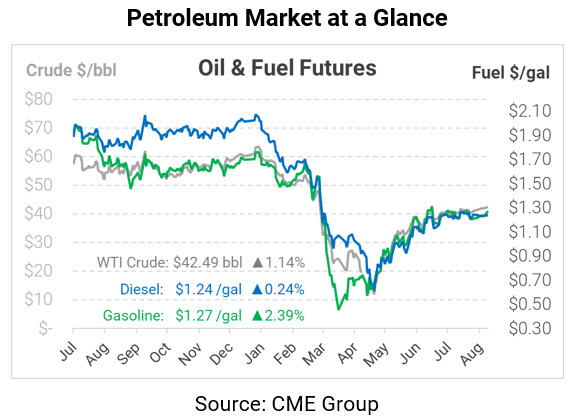

Oil prices are currently moving slightly higher this morning, supported by geopolitical tensions between US and Iran as well as continued market sentiment improvement. WTI crude is currently trading at $42.49, up 48 cents from Friday’s closing price.

Fuel prices are also moving higher, though with differeing degree. Diesel prices are currently trading at $1.2397, a light 0.3 cent move since Friday. Gasoline is seeking hefty 2.4% gains, trading up 3 cents to $1.2744.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.