Report Shows Slowing US Oil Production

In light of the holidays, FUELSNews will resume normal publications on January 2. Happy Holidays and thank you for reading!

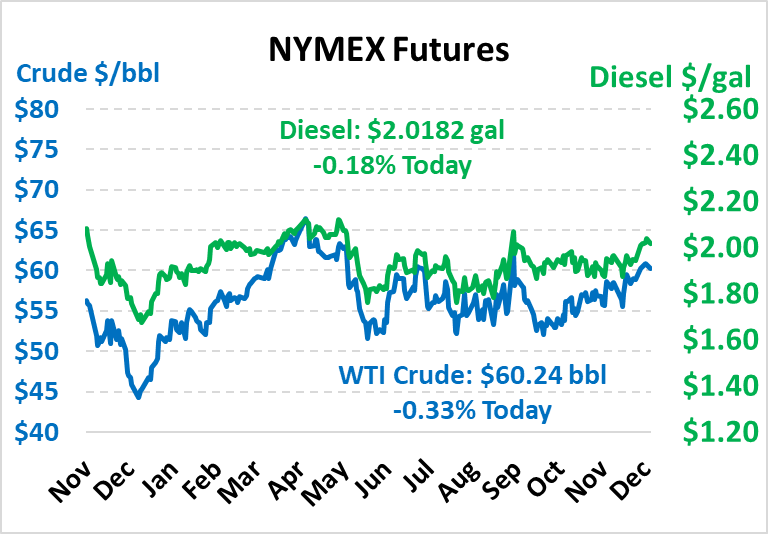

After hitting multi-month highs last week, the oil rally fizzled out on Friday, with prices falling almost a dollar after gaining roughly $6/bbl since Dec 1. With holidays keeping trading volume low, any major long-term price developments this week are unlikely absent major fundamental changes. Crude oil is currently trading at $60.24, down 20 cents from Friday’s close.

Fuel prices also pulled back a bit on Friday, particularly in diesel markets. Diesel is currently trading at $2.0182, down 0.4 cents from Friday’s close. Gasoline prices are trading at $1.6978, down 0.8 cents.

As we approach the new year, traders are looking for any clue into what the new year will hold for oil markets. While the demand side of the equation, focused on trade and economic developments, has been a heavy feature in the news lately, US supplies have slipped somewhat below notice. A recent IHS report, though, is changing that.

According to the report, US producers will have to drill far more in 2020 just to maintain comparable output. Permian basin output began 2019 at 3.8 MMbpd, and by the end of the year those same rigs (not counting new production) lost 1.5 MMbpd – a massive 40% loss in just one year. The report comes as US rig counts have been declining for the past year, with recent rig counts down 25% from one year ago. While the IHS does predict 440 kbpd production growth next year, that’s tiny compared to past year growth. With the US dominating global production growth for the past few years, the slowdown may spell tighter markets in the next two years as producers cut back to improve their financial positions.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.