Range-Bound Oil Market Watches US-Iran Talks

Oil prices plunged lower this morning, retreating from their rally earlier this week that sent Brent crude prices above $70/bbl. US-Iran nuclear talks spooked markets, since a renewed deal would bring 2 MMbpd of Iranian oil back to the market. Russia’s ambassador to the International Energy Agency (IEA) commented that talks have seen “significant progress” in recent days.

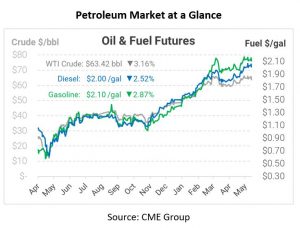

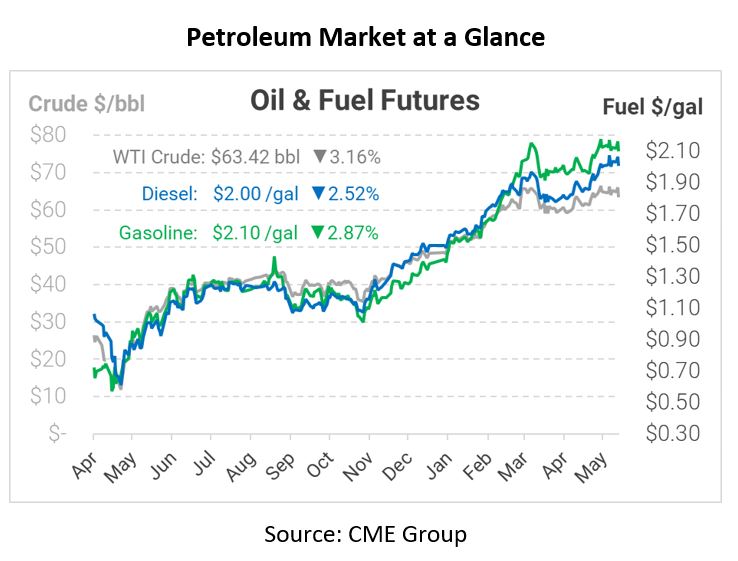

Over the past few weeks, WTI crude – the US’s dominant oil contract – have kept to a $63-$66/bbl range. Although there have been a few big rallies and selloffs, they have not been enough to meaningfully deviate from this range, which has held since late April. Markets rally on strong demand data and projections of supply constraint, then sell as traders consider rising COVID-19 cases in Asia and the possibility of higher interest rates in the US.

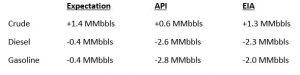

The EIA reported weekly inventory data, the first report to incorporate data on the Colonial Pipeline outage. True to expectations, fuel inventories fell in PADDs 1B (Central East Coast) and 1C (Lower East Coast) while rising a combined 6.9 million barrels in the Gulf Coast. Overall, fuel inventories fell throughout the country, but crude inventories rose. Refinery activity rose for the week to 86.3%, but has not yet hit pre-outage highs set in late April.

This article is part of Daily Market News & Insights

Tagged: Colonial Pipeline, Inventories, Iran

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.