Quiet Oil Trading as Unemployment Claims Fall

It’s a quiet morning for oil prices heading into the weekend. Prices enjoyed a strong lift this week from economic stimulus and a supportive inventory report from the EIA. Markets are looking ahead to an OPEC meeting set to take place next week, where the group will be evaluating markets to determine the efficacy of current cuts and recommend future steps that need to be taken.

In economic news, the weekly new jobless claims declined to just 963,000 jobs, the lowest level since lockdowns began in March. Last week, a payroll report showed America adding 1.8 million jobs, taking unemployment to 10.2%. While markets are making headway slowly, at least 15.5 million people remain on unemployment insurance, down from the May peak of 25 million people but more than 12 million above normal levels. With more employees returning to their workplace, expect to see gasoline demand continue normalizing.

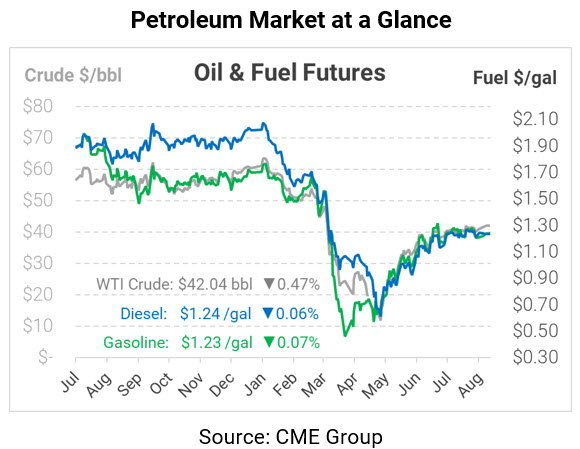

Oil prices are mostly unchanged from yesterday. WTI crude is trading at $42.04, down 20 cents from Thursday’s closing price.

Fuel prices are trading sideways as well. Diesel prices are currently $1.2373, down fractionally from yesterday. Gasoline is $1.2339, also down by just a few points.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.