Q3 Summary: Renewable Fuels

Editor’s Note: The following article is re-printed from FN360 Q3 2017. Renewable fuels are an important part of America’s energy portfolio, and can impact prices by altering supply/demand trends. The legislation mentioned below to extend the biodiesel tax credit remains unpassed following the recent tax bill, but some believe that upcoming legislation to avert a government shutdown may include a number of tax extensions, including for biodiesel. Stay tuned as more develops.

Bipartisan Legislation Introduced to Extend & Phase-out Biodiesel Tax Credit

On July 17, Representatives Diane Black (R-TN) and Ron Kind (D-WI) introduced bipartisan legislation that would extend the biodiesel blenders’ tax credit, ultimately phasing it out over five years. The Biodiesel, Renewable Diesel, and Alternative Fuels Extension Act of 2017 (H.R. 3264) would reinstate the tax credit for all biodiesel blenders at $1 per gallon in 2017 and 2018, falling to $0.75 per gallon in 2019 and $0.50 per gallon in 2020 and 2021, and finally phasing out to zero in 2022.

For over ten years, the blenders’ credit has incentivized the blending and sale of biodiesel. However, the credit’s expiration at the end of 2016 made it difficult for retailers to sell biodiesel in a cost-competitive manner relative to unblended diesel, impacting market participants’ ability to properly plan and make business decisions. H.R. 3264 would reinstate this vital credit and provide five years of tax certainty, allowing businesses to plan for the eventual phase-out of the credit. The bill would keep the credit at the blender level, circumventing an effort by certain lawmakers to change the credit to a producer’s credit. Transforming the credit into a producer’s credit would have essentially created a tax on imported biodiesel and raised costs for consumers.

Brad Puryear, Mansfield Energy’s General Counsel, states, “The blenders’ credit encourages fuel marketers to expand usage of biodiesel, which contributes to American energy independence, promotes cleaner energy, and supports the mission of the Renewable Fuel Standard. The blenders’ credit also results in a more competitive price of diesel fuel at the pump for all consumers. The phase-out is fiscally prudent and provides businesses with clear direction and time to adapt to changes.”

EPA Proposes Renewable Volume Obligations for 2018

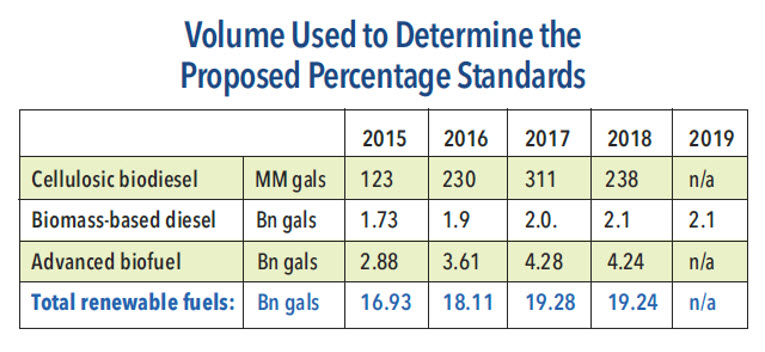

In early July, the Environmental Protection Agency (EPA) proposed Renewable Volume Obligations (RVOs) for 2018 under the Renewable Fuel Standard (RFS). RVOs are the amount of renewable fuels required under the RFS to be blended into the nation’s fuel supply every year. The EPA also proposed RVOs for Biomass-based diesel (BBD) for 2019. EPA is again proposing to use its waiver authority to lower the volumes below their statutory levels and is setting forth volume requirements for cellulosic biofuel, advanced biofuel, and total renewable fuel that are lower than the 2017 requirements.

On July 28, in Americans for Clean Energy v. EPA, a federal court struck a blow against the EPA by ruling the agency had misused its waiver authority in lowering certain fuel blending requirements under the RFS Program. The courts declared the 2016 RVOs were lowered improperly.

The EPA had lowered the volumes based on a waiver authority that lets the agency adjust for an “inadequate domestic supply” of biofuels available for blending. The EPA, however, had determined inadequate domestic supply by using both supply and demand-side factors. The Court found that the demand-side factors were not relevant in determining domestic supply, stating that the EPA may not “consider the volume of renewable fuel that is available to ultimate consumers or the demand-side constraints that affect the consumption of renewable fuel by consumers.”

Biofuel producers are supporting the court’s decision, as they have long argued that RVOs have been set too low. Certain oil industry stakeholders, however, remain concerned that RVOs are still too high. The EPA has said it is still reviewing the decision, which has created substantial uncertainty regarding the potential consequences for affected markets. Comments on the 2018 proposed RVOs were due August 31st.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.