Prices See Heavy Losses Following Discussion Between OPEC and Russia

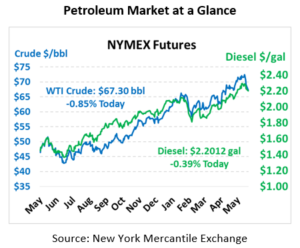

The oil complex continues to move lower this morning following a week of heavy losses. Chatter surrounding the potential for OPEC and Russia to increase its production by 1mmbpd spurred a major sell-off in the market. Crude oil ended the week down by $4.65 from its opening price on Monday at $67.88. This morning, prices have lost another 58 cent to trade at $67.30.

Fuel prices are also in the red, tracking crude lower. Both Diesel and gasoline saw losses of over 5 cents on Friday, closing at their lowest values in over two weeks. Prices are continuing their downward trek this morning with gasoline leading the way. Gasoline is currently trading at $2.1661, down 1.53 cents. Diesel is down 86 points to trade at $2.2012.

The market remains focused on rhetoric between OPEC and Russia discussing a potential production increase due to the decline in Venezuelan supply and the expectation of lower Iranian exports. Fear of the world market being flooded with 1mmbpd of supply sent prices on a downward spiral over the holiday weekend. A decision will be made at the meeting in Vienna on June 22nd.

Tropical Storm Alberto Weakens to a Tropical Depression

Tropical storm Alberto made landfall on Monday brining heavy rain to Florida, Alabama and Mississippi. The tropical storm has weakened to a tropical depression and is forecast to move up through Tennessee to the Great Lakes region throughout the week. Heavy rainfall could bring flooding to local locations; however, Mansfield does not expect supply or carrier limitations to occur at this time.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.