Prices Rebound after Huge Drop on Friday

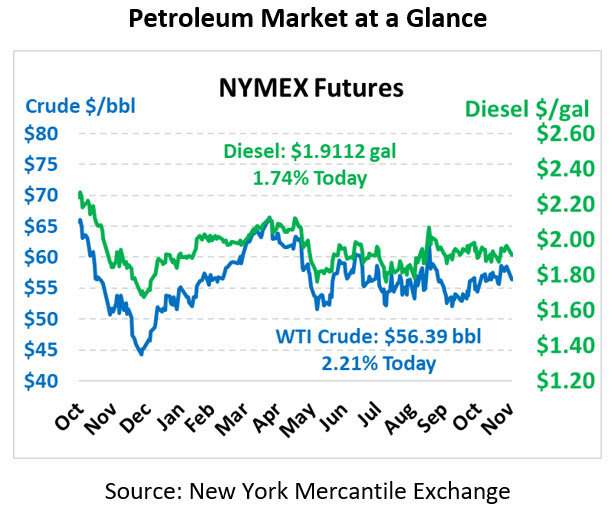

The turkey hangover seeped into markets on Friday, bringing the largest price drop since October. WTI crude gave up just shy of $3/bbl, falling from over $58/bbl to just above $55/bbl. This morning, prices are rallying back once again. Crude oil is trading at $56.39, up $1.22 cents.

Fuel prices also crashed lower, with diesel down 6.8 cents and gasoline down 8.2 cents. This morning, markets are slowly starting to regain some of those losses. Diesel prices are trading at $1.9112, up 3.3 cents since Friday’s close. Gasoline is at 1.6127, up 2.2 cents.

The steep loss on Friday came as Russia rolled back any bullish comments regarding OPEC cut extensions. Russia’s energy minister Alexander Novak said a decision to extend production cuts ought to be made closer to April 2020, when the current agreement expires. Markets are expecting an extension in the December OPEC meeting, and possibly steeper cuts as well. Combined with low volume trading due to the holidays, the put-off from Russia caused markets to plummet. This morning, however, comments from Iraq’s oil minister are suggesting the group will consider deeper cuts at its next meeting, spurring today’s recovery.

Looking closer to home, the EIA’s data officially confirmed that the US was a net exporter of petroleum in September, the first time since records began decades ago. Already the world’s largest producer of crude oil, this new status change highlights the growth of America’s oil industry on the global stage, particularly the growth of export infrastructure.

The change also represents an interesting departure from the past. As a net consumer of petroleum, the US economy historically benefitted from low oil prices. Now that production and consumption are more balanced, the US economy may now, on net, benefit from higher oil prices (though in an uneven manner). High gas prices have historically been a key political issue, influencing elections and representing an incumbent administration’s effect on consumers. Nearly every president has at least paid lip service to trying to lower gas prices. With more Americans (especially in producing states like Texas and Oklahoma) now benefiting from higher oil prices, it will be interesting to see how politicians respond.

This article is part of Crude

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.