Prices Fall on Chinese Demand Concerns

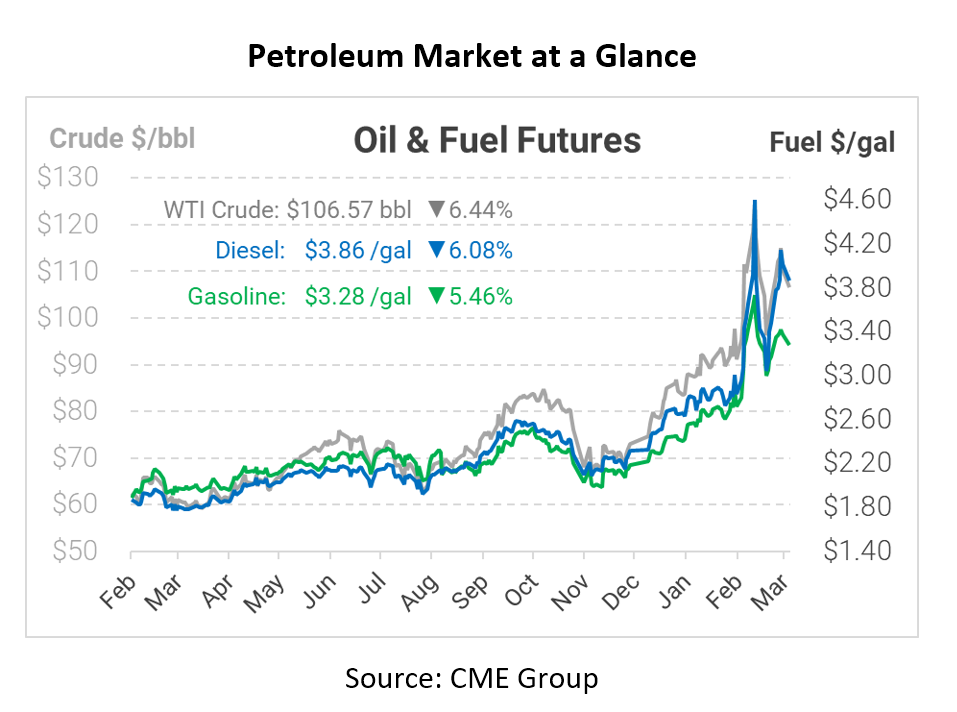

This morning crude prices are down dramatically over Chinese demand concerns as Shanghai initiates a lockdown to reverse the spread of COVID-19. WTI crude was as low as $106.57 and continued to fall slightly. This lockdown proves that COVID-19 is not over and that there is still a significant threat to oil markets.

Shanghai, China’s financial hub, initiated the lockdown in two stages. With the government closing tunnels and bridges and restricting highway traffic, over 26 million people will be affected by the lockdown. With China being the world’s second-largest economy, the lockdown has inspired fear for consumption, negatively impacting commodity prices. The lockdown will be in effect for at least nine days. Many citizens of Shanghai have now begun to stockpile food, fuel, and other living necessities with the fear that this lockdown may just be a glimpse of what is to come if the situation worsens.

The worry now is that China’s zero-COVID policy may have some harmful effects that spread out for an extended time. If a lockdown was initiated this fast in one of the world’s largest cities, many fear that Chinese officials will begin to shut down other major business hubs if the situation worsens. Being the world’s largest importer of crude oil, China is expected to lessen crude imports by almost 800,000 barrels per day (bpd) in April compared to their historical numbers. That’s good news for global fuel consumers since oil that would have gone to China can be routed elsewhere to alleviate high prices.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.