Prices Fall as Storm Threats Recede

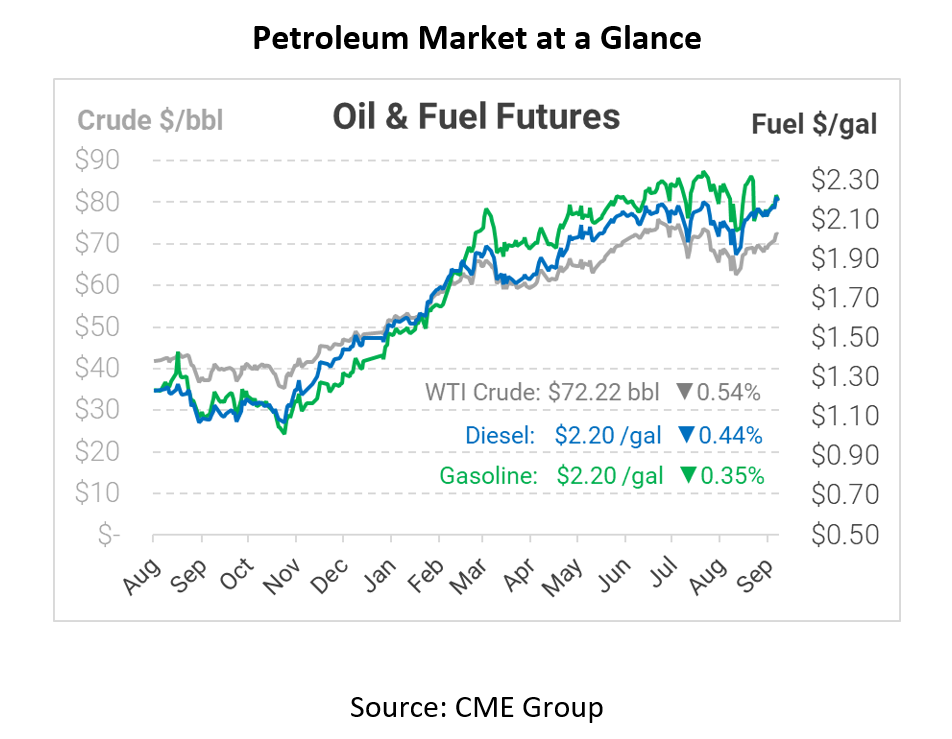

This morning prices fell slightly as the threat to Gulf oil production started to dial back with the recent downgrade of Category 1 Hurricane Nicholas into a tropical depression. Today crude oil opened at $72.65, while diesel opened at $2.2065, and gasoline at $2.2084.

As Nicholas recedes, energy companies have been able to restart their pipeline operations and restore electricity to many areas of Louisiana and Texas. Because Nicholas receded quickly, these companies were able to focus on the continuation of recovery efforts from the effects of Hurricane Ida. Yesterday the Colonial Pipeline resumed gasoline and diesel shipments. While Hurricane Ida severely disrupted fuel supply, Rystad Energy analyst Nishant Bhushan says, “As Nicholas spared U.S. production from further disruptions, it is difficult to see how oil prices can increase further in the near term.”

At least two Texas oil refineries along the coast are expected to remain offline until early October because of damage incurred from Ida. The good news is that the majority are starting to return online, with two large New Orleans refineries expected to restart within the next week. Over the next few weeks, we should begin to see normalcy return. While we are still in the midst of peak hurricane season, things seem to have slowed down in the Atlantic for now, giving recovery teams time to recover and plan for future storms.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.