Prices Continue to Fall After OPEC+ Agreement

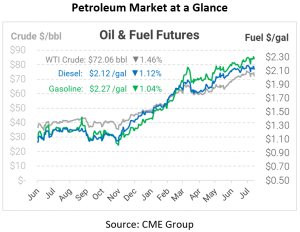

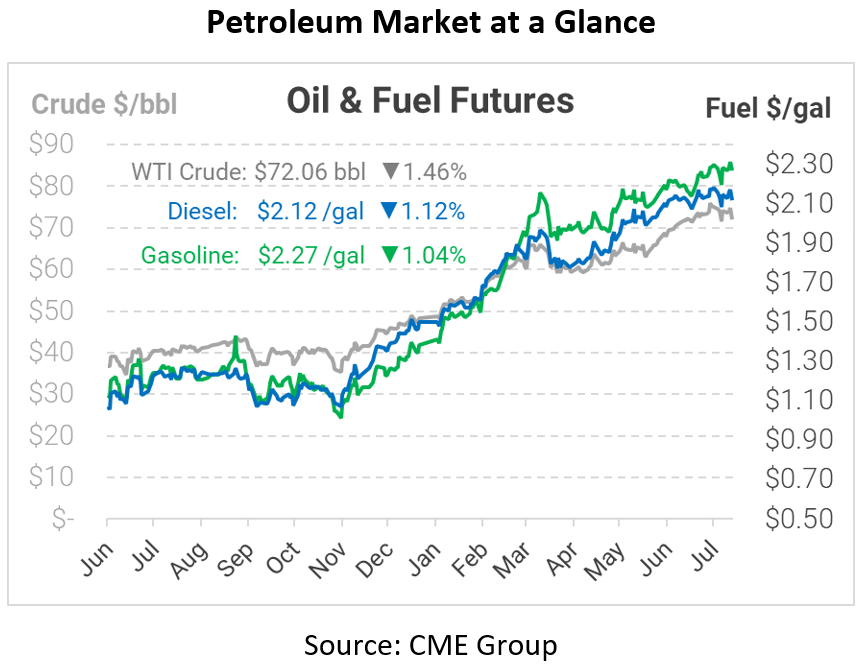

This morning prices continued to fall while posting some of their lowest opening numbers of the week. Crude this morning opened at $72.96, diesel at $2.1379, and gasoline at $2.2926. The agreement between Saudi Arabia and the United Arab Emirates (UAE) is helping to weaken the oil rally, since it will provide more supply each month through December.

The agreement does not guarantee lower prices. In June alone, global oil demand rose by 3.2 million barrels per day; OPEC will increase supply by just 400 thousand barrels per day each month. Although an OPEC agreement will help bring the markets closer to balance, it might be a few months before it can catch up. In the meantime, oil prices could proceed even higher before cooling in Q4.

In other news today, retail gasoline prices continue to soar and breaking 8-year highs. With gasoline well over $3 in many areas of the United States, gasoline is almost a dollar higher than it was last year. $3 per gallon certainly feels expensive for consumers, but in some areas, it’s even higher. In California, residents are paying nearly $4.30 for a gallon of gasoline, the highest price in the country. Gas prices are expected to remain high for some time until the supply chain can balance out, but the OPEC+ deal will undoubtedly help with subduing high retail prices in the future.

This article is part of Daily Market News & Insights

Tagged: gas prices, gas supply, OPEC Agreement, Supply Increase

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.