Presidential Candidates Spar Over Energy Policy

Oil prices are rising this morning despite rising coronavirus cases worldwide. Russia declared they would be willing to maintain deeper production cuts in 2021 if required, though they left open the question of what will be required. Looking ahead, Goldman Sachs reiterated its bullish stance on oil prices in 2021, with rising inflation and a weak US dollar driving a 40%+ gain in the energy sector. In the US, though, the presidential debate shifted focus briefly from oil fundamentals to government policy and long-term trends.

Last night’s debate was ripe with commentary on oil and gas – a topic which so far hasn’t been a key topic in this election. President Trump touted his performance residing over record high US crude production and challenged Former VP Biden on his stances. Biden commented, “I would transition away from the oil industry,” and committed to ending federal subsidies for oil and gas companies. Biden’s platform calls for carbon-neutral energy by 2050, and Biden clarified after the debate that he would not ban oil and gas for “a long time.” The candidates sparred on drilling permits as well, with Biden clarifying that he would only ban new drilling on federal land. Trump supporter and oil billionaire Harold Hamm speculated that Biden’s policies could send gas prices to a whopping $6/gal, though no analysts have echoed those sentiments. Goldman Sachs recently noted that they are bullish on the oil industry’s 2021 prospects regardless of the presidential winner.

Beyond specific oil & gas policies, both presidential candidates will affect oil prices via their economic and geopolitical stances. Moody’s Analytics notes that the stimulus package will have an outsized impact on economic growth and job creation, which by extension will impact oil demand and raise prices. On the other hand, Biden seems more likely to engage with Iran and revitalize the nuclear deal, bringing a flood of oil supply back to the market and sending prices lower. Although Trump is clearly more supportive for US oil and gas producers, the outcome for fuel consumers is less clear. Both candidates have a complex relationship with oil prices, and the economy will likely overshadow any specific energy policy when it comes to commodity prices. Moving parts on both sides of the aisle make it difficult to forecast fuel prices for 2021.

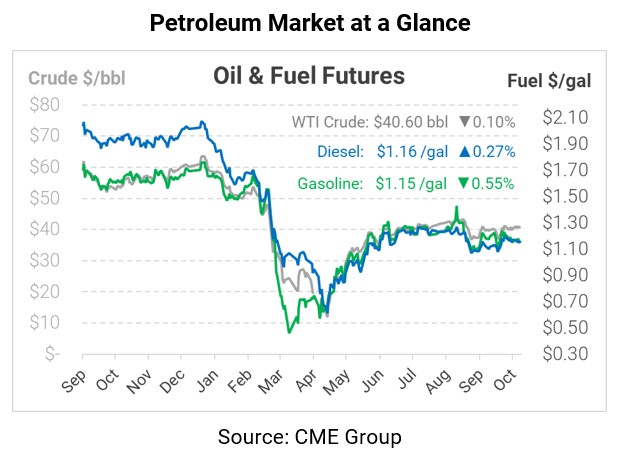

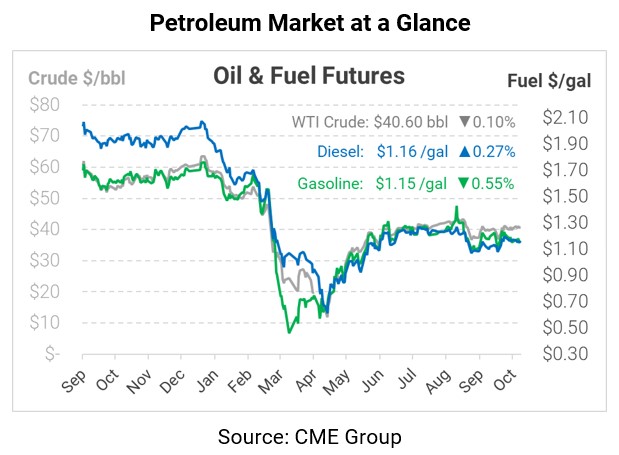

Yesterday saw oil prices climb once again, thanks to Russia’s vocal support for the OPEC+ deal. Crude oil is currently trading at $40.60, unchanged after yesterday’s rally.

Fuel prices are similarly calm this morning. Diesel is trading at $1.1638, a small gain of 0.3 cents. Gasoline prices are drifting a bit lower, trading at $1.1517 after shedding half a cent.

This article is part of Daily Market News & Insights

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.