Pain at the Pump?

As headlines about soaring oil production flood the news, retail fuel prices have been somewhat calmer, rising less precipitously than wholesale fuel prices. Each week, the EIA shares data on national and regional retail prices, giving some insight into what consumers around the country are paying. Last week, U.S. consumers paid, on average, $3.025 per gallon for diesel and $2.567 for gasoline.

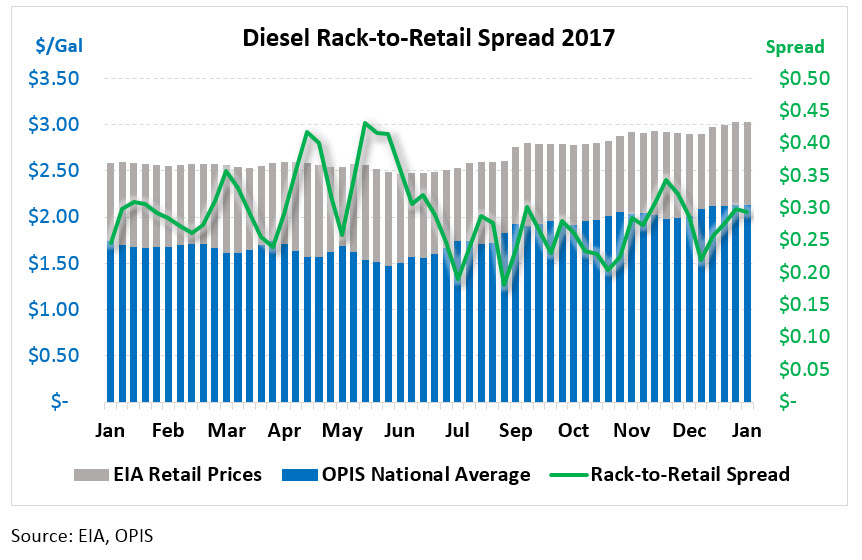

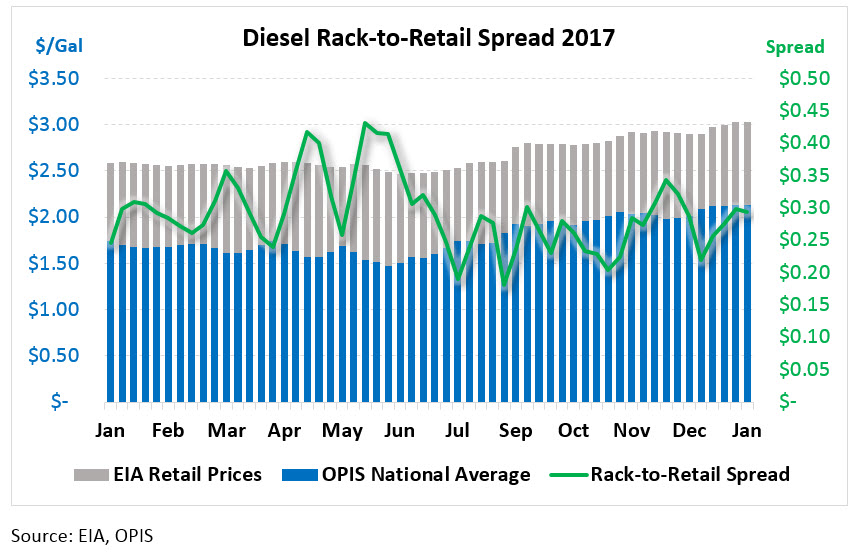

Lower volatility in retail markets is common. When wholesale fuel prices rise, gas stations are hesitant to pass on the higher costs for fear of losing customers. Because customers are so price-conscious, changing stations over a few cents difference, raising prices can be challenging. On the flip side, when prices fall, most stations are slow to lower their price, keeping price movements gradual to avoid shocking customers if prices come back up. Thus, the difference between wholesale and retail fuel prices, called the rack-to-retail spread, can contract and expand over time.

Slow changes in rack-to-retail spread can be seen over the past six months in diesel prices. Between July 2, 2017 and January 1, 2018, wholesale prices across the nation increased by 35%; retail prices increased just 20% during that time. Whenever prices rise, retail customers benefit; on the other hand, wholesale buyers will outperform when prices fall.

Diesel prices in the U.S. have been rising, and are generally 40-50 cents higher than they were this time last year. Since last week, prices across the country averaged a 0.3 cent increase, propelled by gains in the Midwest, Gulf Coast, and Rocky Mountain areas. The East Coast, on the other hand, enjoyed falling diesel prices, likely a correction after weeks of abnormally cold weather pushed prices higher.

Rack-to-retail spreads were suppressed for much of the second half of 2017, as rising diesel prices put a damper on prices at retail stations and truck stops. A brief retreat from rising prices in November gave retail prices a chance to catch up, but prices once again fell out of alignment in December. Overall, the trend has been lower spreads in the second half of 2017, relative to the first half. Consumers have been enjoying more stable prices as a result.

Unlike diesel prices, which are up 40-50 cents since last year, gasoline prices are on average just 24 cents higher than January 2017 prices. The overall trend for gasoline, though, is higher, with large gains in East Coast and Gulf Coast prices offsetting falling prices in the Midwest. Overall, national gasoline prices rose a penny over the last week, and gains in wholesale RBOB prices seem to suggest prices will continue to rise.

Gasoline rack-to-retail spreads are more volatile than diesel, more subject to consumer whims than diesel usually is. The large dip and spike in September was the result of Hurricanes Harvey and Irma, which caused wholesale prices to rise faster than retail stations could follow. The result was numerous retail gas station outages throughout the Gulf Coast and Florida. In the weeks following the storms, retail prices surged to annual highs before returning to normal levels in October. With wholesale gasoline prices on the rise, rack-to-retail spreads have trended lower over the last few weeks.

This article is part of Diesel

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.