Out of Sync: Canadian Outage Ripples through North America

Crude oil is trading higher this morning, along with notable gains in fuel prices. Crude prices gave up 50 cents yesterday, but this morning prices are creeping higher again. WTI crude is currently trading at $68.40, up 32 cents since yesterday.

Fuel prices both gave up a few cents yesterday, as traders engaged in profit-taking following Friday’s huge rally. Today fuel prices are once again heading towards higher ground. Diesel prices are currently $2.1117, a gain of 1.1 cents since yesterday’s close. Gasoline prices are $2.0665, a gain of 1.5 cents.

Out of Sync

WTI prices are soaring in reaction to a supply outage reported by Canadian company Syncrude. What’s going on?

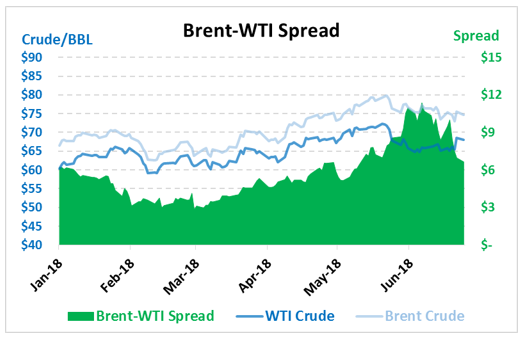

Not long ago, we highlighted that the difference between Brent and WTI crude had expanded to extremely high levels, reaching a peak of $11/bbl difference between the two crude blends. The price spread was caused by two major factors:

- Pipeline Limitations – getting crude from America to the rest of the world requires shipping and exporting infrastructure. While ports have become more capable of facilitating large crude vessels, pipeline capacity carrying crude from oil fields to those ports is limited. Because WTI crude is trapped in the U.S. for now, it pushes down domestic prices.

- Iran Sanctions – when the U.S. pulled out of the Iran nuclear deal, we threatened to impose sanctions on any companies buying from Iran. While America does not use much Iranian oil, European countries do. Europe is heavily reliant on Middle Eastern oil still, so they have less supply available to purchase, driving up European (Brent) oil prices.

As the chart above shows, the spread between American WTI crude and European/international Brent crude has fallen significantly. Yet the two driving factors – pipeline capacity and Europe’s scramble for new supply – are still as much in play as ever. The Syncrude outage has single-handedly helped bring Brent-WTI spreads from over $10 to below $7 in just a week.

Canada’s Syncrude operation ships roughly 350,000 barrels per day of crude oil to the U.S., with much of that crude shipped directly to Cushing, OK. Recall that WTI prices are really a representation of the cost of a barrel of crude in Cushing, OK. If you buy a barrel of WTI crude on the NYMEX futures market, you’re agreeing to receive a barrel of crude in Cushing on a particular date in the future. So when regular supply can’t make it to Cushing, it directly impacts America’s primary crude oil index.

The outage has taken Syncrude’s entire operation offline temporarily. Markets expect supplies to be offline until late July, though Syncrude is attempting to restart the operation next week. Barclays expects output from the company to be 200,000 bpd in Q3, two-thirds the output of their previous forecast.

Cushing, OK has 32.6 million barrels of crude oil available as of last week’s EIA report. On a weekly basis, the Syncrude outage is removing roughly 2 million barrels of crude that would have gone to Cushing – meaning in just one week, 6% of Cushing stocks will be depleted. While other producers will try to fill in the gap, the $4 change in WTI crude relative to Brent shows that markets are still quite tight.

Consumer Impacts

The reduction in Cushing OK stocks will have mixed impacts throughout the country. The northeast generally relies on European crude, so rising WTI prices will have less impact in the region. California is an island of crude and fuel production, so while their prices will be as high as always, they likely won’t turn higher due to this outage.

Consumers who will feel the biggest impact from the Cushing outage are those reliant on Gulf Coast production. Cushing stocks are highly connected both to Gulf Coast refineries as well as to more northern refineries in Oklahoma and the Midwest. As crude prices rise in these areas, consumers will experience relatively higher fuel prices.

Customers around the Great Lakes area will also be impacted. The Canadian outage has brought Canadian crude prices – which have traded at huge discounts to American WTI crude – much higher. Global News reports that while Canadian crude traded around $25 below WTI in June, it could rise much higher, trading just $15/bbl below WTI next month.

Chicago refineries typically prefer using Canadian crude because of the steep discounts to American crude; in turn, discounts can be passed on in fuel prices. Chicago fuel has been quite competitive over the past couple years, as evidenced by projects such as switching the direction of the Laurel pipeline in Pennsylvania to allow Chicago fuel to flow east. With Canadian crude becoming more expensive, Chicago fuel could become less competitive – at least in the short-term – causing consumers to feel higher prices on fuel.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.