OPEC+ – Will They Balance the Market or Stick to Their Plan

WTI crude and products are up somewhat this morning, trading sideways at times as markets consider a growing second wave of coronavirus cases around the world. The US has seen 30,000 to 35,000 new cases per day in September but is now back up to 50,000 daily new cases. These kinds of statistics are causing concern that new lockdowns and restrictions will further diminish demand for fuel as we enter the already lower demand winter months.

In OPEC news, OPEC meets on Monday to discuss plans and cuts. There had been recent chatter that OPEC+ would not ease supply cuts in January as planned. The shrinking demand for crude as forecast by OPEC recently was the catalyst for speculation that OPEC+ would tighten supply to balance the market. These hopes were sunk by recent reports that OPEC+ will indeed continue with easing supply cuts in January. Instead, Crown Prince Mohammed Bin Salman, and Russian President Vladimir Putin will continue to urge other OPEC+ countries to comply with stated cuts. This is an ever changing situation and attitudes could shift depending on the market’s movement.

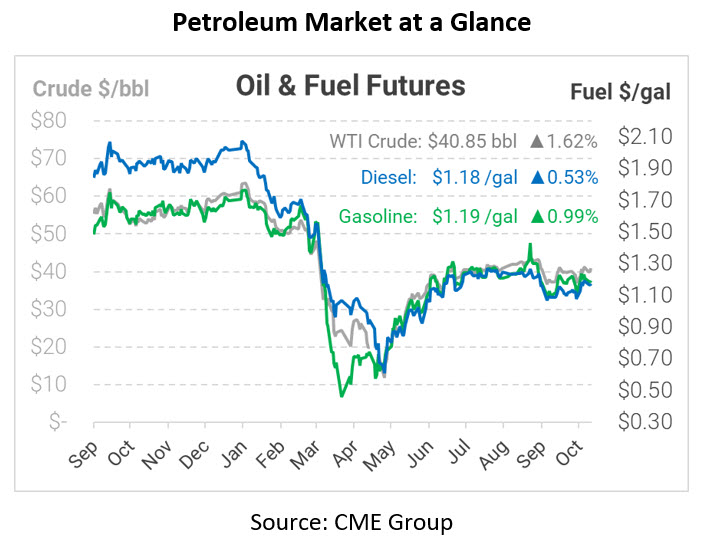

Crude prices are up this morning. WTI Crude is trading at $40.85, a gain of 65 cents.

Fuel is up in early trading this morning. Diesel is trading at $1.1752, a gain of 0.6 cents. Gasoline is trading at $1.1944, an increase of 1.2 cents.

This article is part of Daily Market News & Insights

Tagged: coronavirus, demand, opec, Russia

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.