OPEC Supplies Tighten, Set Stage for Higher Future Prices

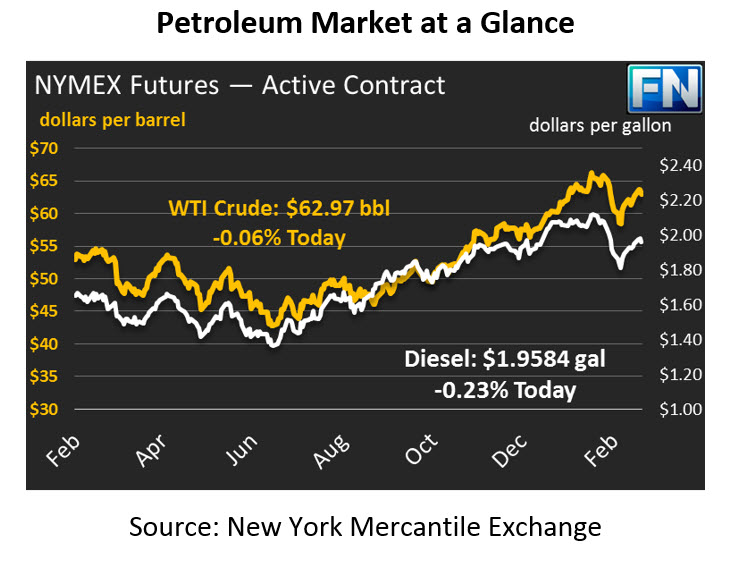

Oil prices are declining this morning after trending fairly high last week. Markets appear to be taking some profits off the table – the last time WTI prices were this high, they hit a ceiling near $69/bbl, so some traders are getting out of the market while prices are near this level. Early morning losses have reversed somewhat, keeping losses light. WTI crude prices this morning are $68.03, down 7 cents.

Fuel prices are also moving lower after ending last week well in the black. Diesel prices are currently $2.1472, down 0.4 cents. Gasoline prices are declining faster, trading at $2.1072, a loss of 2.0 cents.

While prices are lower this morning, the news over the weekend tended to be more supportive of higher prices. While the Baker Hughes U.S. rig count rose by 8 rigs in Friday’s report, market analysts are increasingly calling for higher prices.

On Friday, Merrill Lynch analysts called for $80 Brent crude (up from around $74 this morning) by the end of Q2. The group sited ongoing supply instability, particularly in OPEC nations. Venezuela is the most notable disruption – the country’s ongoing political instability has made oil investments oil financially poisonous, taking Venezuela’s heavy crude off the market. Venezuela’s crude oil is especially important to the U.S. since WTI light crude needs is typically blended with Venezuela’s heavy crude to produce an ideal blend stock for refineries.

In addition, Angola’s production has been in a state of steady decline over the past year. Once among the most prolific African producing nations, Angola’s crude output has fallen to its lowest point since 2008. The overall decline in OPEC production sets the stage for escalating prices – one well known hedge fund manager, Pierre Andurand, said $300/bbl crude is possible in the next few years. Oil wells naturally decline in production over time, requiring new wells to come online to replace them. Recent lack of investment in new drilling internationally (excluding the U.S.) could create significant supply crunches down the road.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.