OPEC+ Stays the Course, Pushing Oil To Fresh Highs

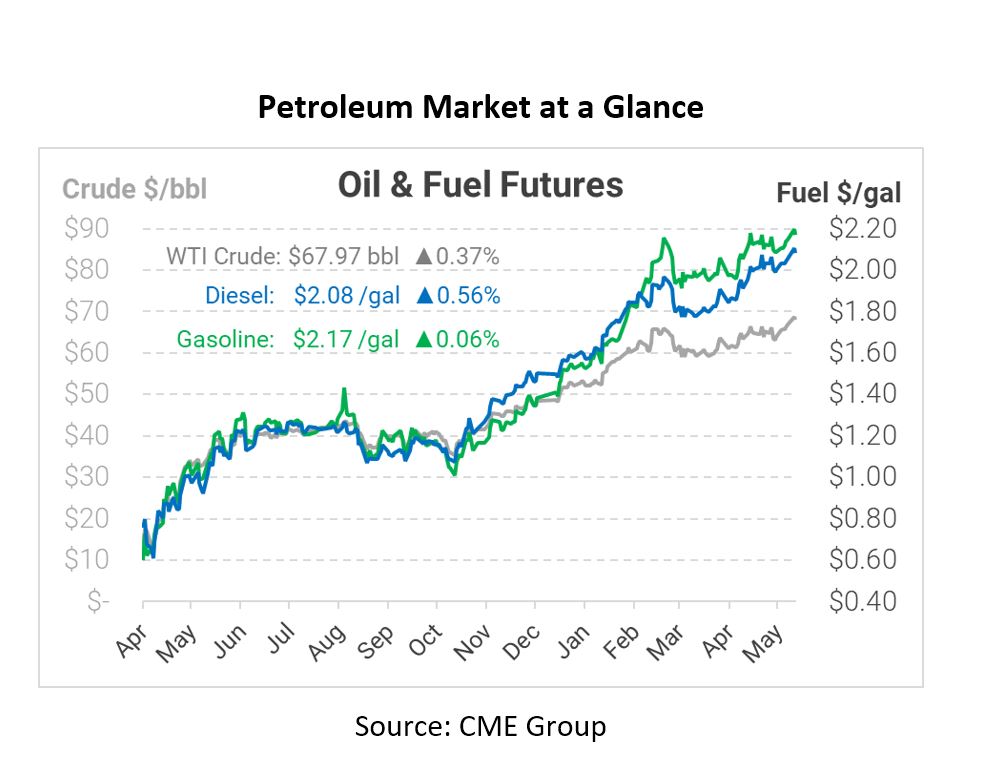

Crude oil prices climbed to a new multi-year high yesterday, following the OPEC+ meeting yesterday. As expected, the group opted to continue gradually adding supply. OPEC’s consistency instilled confidence that the group will maintain a conservative approach.

Global demand is expected to grow by an additional 6 million barrels per day in the second half of 2021, and OPEC+ will be cutting nearly as much in late July. Odds are good the group will continue to slowly bring on, say, 250-500 kbpd per month in the latter half of the year, giving demand time to keep up with supply growth. If OPEC maintains cuts for longer, prices could rocket higher; on the other hand, faster supply increases could send prices back down into the $50s. With US producers practicing fiscal restraint, OPEC+ sets the tone for the entire world’s oil prices.

OPEC’s stay-the-course mentality may be aided by struggling negotiations between the US and Iran. Earlier this week, the International Atomic Energy Agency circulated two reports that detailed Iran’s uncooperative spirit during inspections. Yesterday, an Iranian official conceded that a deal could take months. Although oil traders are gearing up for 2 MMbpd of Iranian oil to hit global markets, it may be a while before those barrels materialize.

This article is part of Daily Market News & Insights

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.