OPEC+ Meets Today: Here’s What We Know

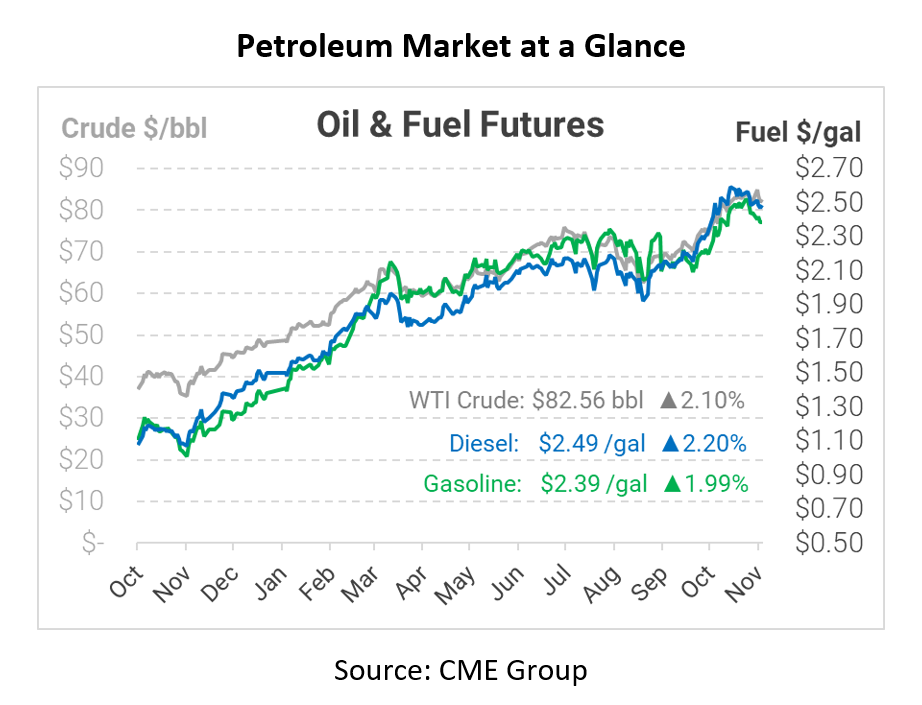

This morning, oil prices rose over 2% ahead of the awaited OPEC+ meeting scheduled for later today. The expectation is that OPEC+ will continue its slow output increases, even though many world powers are calling for more. Today crude oil opened at $80.18, diesel at $2.4171, and gasoline at $2.3320.

While most meetings address multiple topics, today’s OPEC meeting will focus on their production increase stance. Many analysts suggest that even though countries like the United States have asked OPEC+ for more supply output, the oil cartel will most likely maintain their original increase of 400,000 barrels per day (bpd). The reason analysts believe production output will remain the same stems from the simple stance OPEC+ is taking; they are worried about the implications of new COVID cases and their effect on the market. The uncertainty is the deciding factor for the group, but whether they succumb to the pressure of other world powers is yet to be determined.

One movement that has started to make progress is the idea of larger oil companies undercutting OPEC+ by producing more oil. If this were to happen, these larger companies worldwide could start to influence supply and demand in certain regions more immediately. Companies such as BP, Chevron, and Exxon have already begun initial talks about this possibility. Increased private production is likely to begin early next year. With OPEC+ staying put, and major oil companies thinking of alternative options to help curb the price of oil, there is sure to be a shake-up in the oil industry in the coming weeks.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.