OPEC Meeting, Saudi Threats

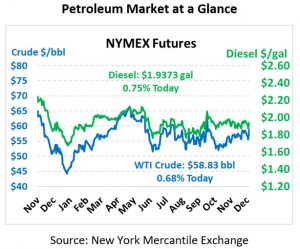

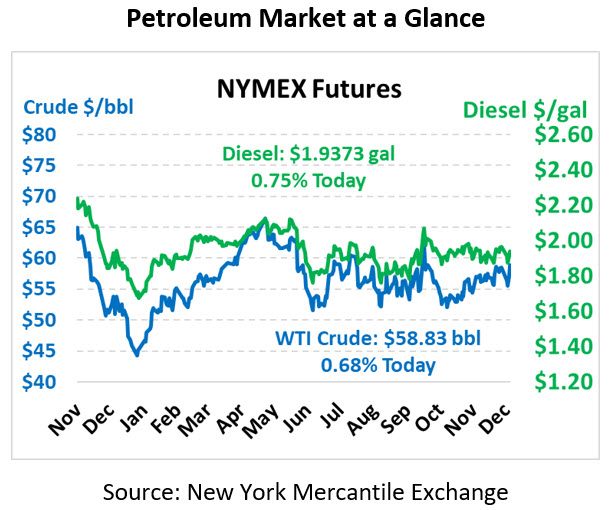

OPEC rumors and bullish inventory news are lifting the markets. WTI Crude is trading at $58.83, a gain of 40 cents.

Fuel is up in early trading this morning. Diesel is trading at $1.9373, a gain of 1.4 cents. Gasoline is trading at $1.6228, a gain of 1.9 cents.

On Wednesday, crude prices rose more than 3% after rumors came out of the Saudis issuing a threat to OPEC members to comply with production cuts or the Saudis would flood the market with cheap crude. The Saudis used such a tactic in 2014 to try to drive out shale oil producers in the US. This time, the threat was leveled at countries who were not holding up their end of previously agreed upon cuts – namely Iraq and Russia.

The current cuts take 1.2 MMbpd off the market with the lion’s share of cuts coming from Saudi Arabia over-complying with their allotment. If non-complying countries would fall in line, OPEC could take an additional 400 kbpd off the market – taking the burden off Saudi Arabia. In addition, rumors swirled of talks of deeper cuts beyond what is currently on the table. These rumors and reports helped to lift markets yesterday and today along with bullish inventory news from the EIA.

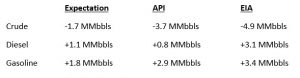

The EIA reported a larger-than-expected draw for crude of 4.9 MMbbls, verses an expected draw of 1.7 MMbbls. At Cushing, the EIA reported a 0.3 MMbbl draw. The EIA reported distillates had a larger-than-expected build and gasoline also saw a larger-than-expected build.

In other news, OPEC production, excluding Iran, dropped to its lowest level since July. Saudi Arabia, Iraq, Kuwait and the U.A.E., which together account for around 70% of OPEC’s entire production, shipped an average of 14.79 mmbpd of oil in November, according to Bloomberg tanker-tracking data. That represents a drop of 970 kbpd from October.

This article is part of Crude

Tagged: eia, Iraq, Kuwait, OPEC members, Saudi Arabia, Saudis, U.A.E., US

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.