OPEC Jawboning Sways Markets

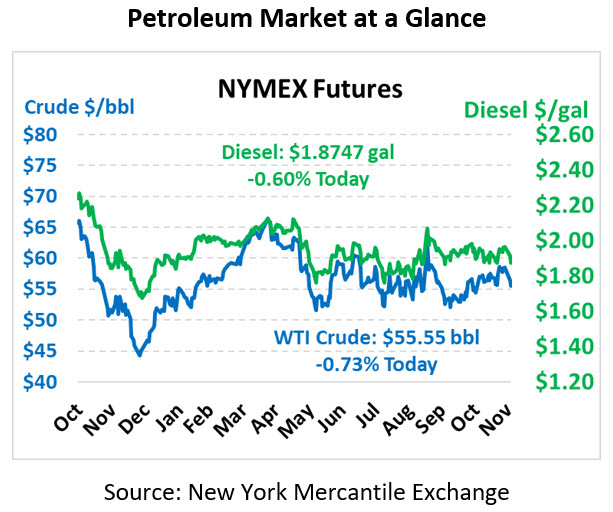

Crude is down in early trading this morning. News of deeper OPEC supply cuts seem to be offset by weak manufacturing data coming from the US. Crude is currently trading at $55.55, a loss of 41 cents.

Fuel prices are down in line with crude. Diesel is trading at $1.8747, a loss of 1.1 cents. Gasoline is trading at $1.5634, a loss of a penny.

Yesterday’s rally centered on news from OPEC partners Iraq and Saudi Arabia saying that they were pushing for deeper supply cuts up to 400 kbpd. The OPEC jawboning was supported by positive economic data coming from China, however, news that US factory activity contracted in November offset some of the positive news from China. Yesterday’s rally retreated from session highs on the disappointing US manufacturing news and was only a partial recovery from the sharp losses of last Friday.

In trade news, Trump unexpectedly announced tariffs on aluminum and steel from Argentina and Brazil. Last year Trump placed tariffs on all foreign aluminum and steel but had struck a deal with Argentina and Brazil to exclude them from tariffs. This newest tariff was in response to ”massive devaluation of their currencies” at the expense of American farmers. In addition, Trump threatened to place US tariffs on $2.4 billion of French goods in retaliation for a digital services tax that Washington says is discriminatory. French Economy Minister Bruno Le Maire promised a strong EU response to any tariffs. The trade news drove equities lower and stunted yesterday’s crude rally.

In OPEC news, according to a Bloomberg survey of officials, OPEC ‘s total output decreased by 110 kbpd to 29.7 mmbpd last month with the biggest drops in production out of Angola and Iran. In addition, protests and fighting continued in the Middle East yesterday with Libya’s NOC pausing production from the 73 kbpd El-Feel oilfield amid fighting between the Libyan army and Khalifa Haftar’s militias. Such a small number of barrels should have little to no impact on global prices, but the world will keep an eye on any conflict that could impact oil supply.

This article is part of Crude

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.