OPEC Hesitant to Increase Output

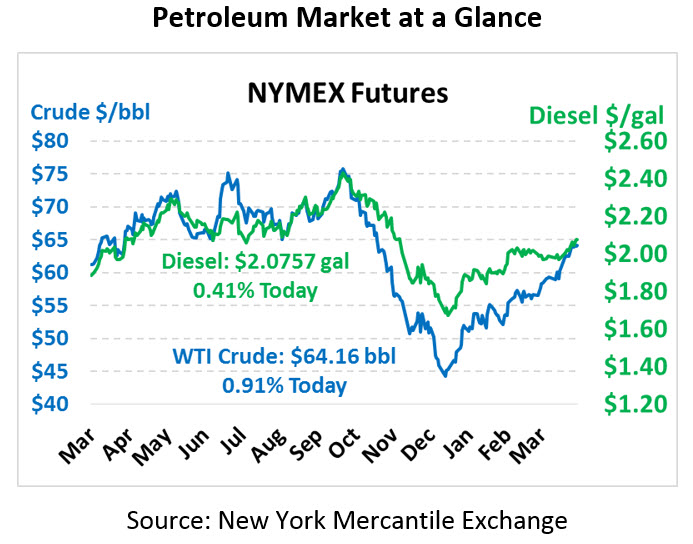

Markets retreated a bit yesterday, but this morning are on track to recapture their gains and close the week strong. A weaker dollar is providing some support along with on-going political and geopolitical uncertainty. Crude is currently trading at $64.16, up 58 cents.

Fuel prices are receiving a lift as well. Diesel prices are trading at $2.0757, up 0.9 cents. Gasoline prices are $2.0333, up a more meager 0.2 cents.

In Libya, the National Oil Company’s head Mustafa Sanalla warned markets that the advance of militant forces on the country’s capital “could wipe out” Libya’s production. At its peak, Libya can produce around 1 MMbpd of crude oil. Most at risk is their largest oil field, El Sharara, which is often a target during domestic upheavals.

OPEC sources indicated that OPEC would only raise its output quotas if crude surpassed $80/bbl (for America’s WTI crude, that’s roughly $73/bbl) or if Venezuela and Iran suffer significantly steeper losses in the coming months. Of course, recent comments from Russia have indicated a desire to exit the deal and lift their production, though Putin later commented that it’s too early to make a decision on cuts. The OPEC source also hinted that any increase in output would be less than 1.2 MMbpd, which is the current cut level – meaning OPEC will still be actively regulating prices, just at a slower pace.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.