OPEC+ Extends Talks, UAE Objects to Deal

OPEC+ talks have stalled this week due to disagreements between member countries. Saudi Arabia and Russia agreed yesterday to increase production gradually by 2 MMbpd by the end of the year. The agreement would also extend the cuts, which are slated to end in April 2022, through the end of 2022. However, objections from the UAE are delaying the ratification of the amended deal.

Although the UAE agrees to the proposed changes, they want acknowledgment that their base of production is higher than originally agreed, effectively allowing them to produce another 700 kbpd. UAE officials say they originally agreed to a lower base level as a gesture of goodwill, expecting cuts to end by April 2022. The country has invested in increasing production capacity for the long-term, so they want to get back to higher output levels. The UAE’s objections likely will not derail the overall agreement, but it has delayed it a bit. If OPEC+ agrees to the UAE’s terms, prices could fall slightly more than they would have, since it will effectively bring the production increases to 2.7 MMbpd.

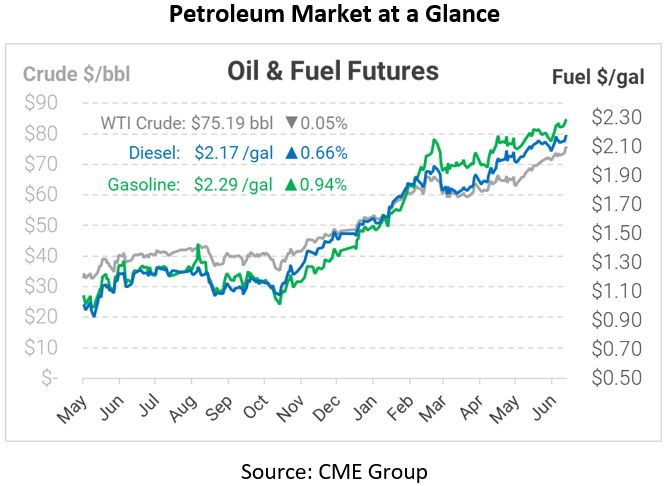

The cuts come as numerous analysts have predicted rising oil prices in the future. Goldman Sachs and JP Morgan both see prices averaging more than $80 later this year, while Bank of America is calling for $100 oil. These forecasts allow for more OPEC production, focusing instead on the demand-led recovery. One report notes that oil prices will keep rising until it begins destroying demand, suggesting that more pain at the pump is forthcoming.

This article is part of Daily Market News & Insights

Tagged: crude, opec, Russia, Saudi Arabia

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.