OPEC Downplays Impacts of Coronavirus to Oil Demand

Yesterday, crude closed at the lowest level since mid-October, with the coronavirus threatening global energy demand. Alarm over the potential for China’s coronavirus to limit travel and economic activity has already pushed oil prices down by approximately 10% since early last week. The death toll from the coronavirus rose to 81 and the Chinese government extended the Lunar New Year holiday to Feb. 2, trying to keep as many people as possible at home to prevent the virus from spreading further.

China’s GDP was already expected to slow to a three-decade low below 6 percent this year. S&P Global Ratings said that the effect of the virus could balloon to a 1.2 percentage point reduction in GDP. This reduction in GDP would have a proportional effect on oil demand.

Saudi Arabia’s energy minister tried to tamp down the panic, noting that there is “very little impact” on global oil demand. He added that there was also “extreme pessimism” during the SARS outbreak in the early 2000s but that ultimately the impact on oil consumption was not significant.

Both Saudi’s Energy minister and the UAE’s energy minister stated that OPEC+ will meet in March to discuss the market and will, if required, consider all options to ensure continued market balance. One of the rumors is the possibility of the extending the latest production cuts – which expire at the end of March – until the end of the year. Another option is to cut deeper from current levels.

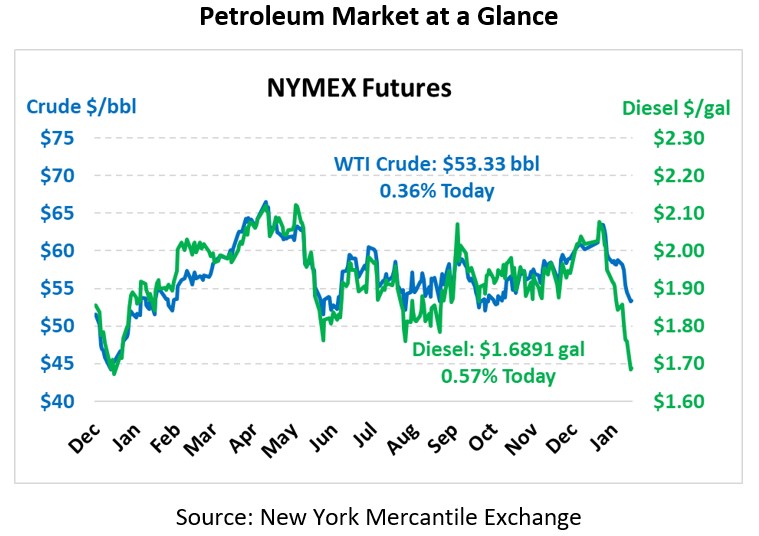

Crude prices are relatively unchanged this morning. Crude is currently trading at $53.33, a gain of 19 cents.

Fuel prices are up. Diesel is trading at $1.6891, a gain of 1.0 cents. Gasoline is trading at $1.4965, a gain of 1.3 cents.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.