OPEC Cuts Supply Quotas – Are They Defending $100 Oil?

After a long holiday weekend for the US and Canada, markets are trading slightly higher this morning following OPEC’s decision to cut production quotas in October. There’s also some bearish news, including China’s COVID lockdowns and expected interest rate hikes in Europe. But analysts are abuzz about OPEC’s decision, which could have more long-term consequences beyond the mere short-term change.

On Monday, OPEC members agreed to cut production by 100 thousand barrels per day in October, undoing last month’s tiny output hike and following over a year of increasing production. Because the group is already struggling to keep up with rising quotas, the cuts are more symbolic than substantive. Although insignificant for near-term supply, the move could be a warning that OPEC will respond to future price dips with more cuts in an attempt to keep prices higher.

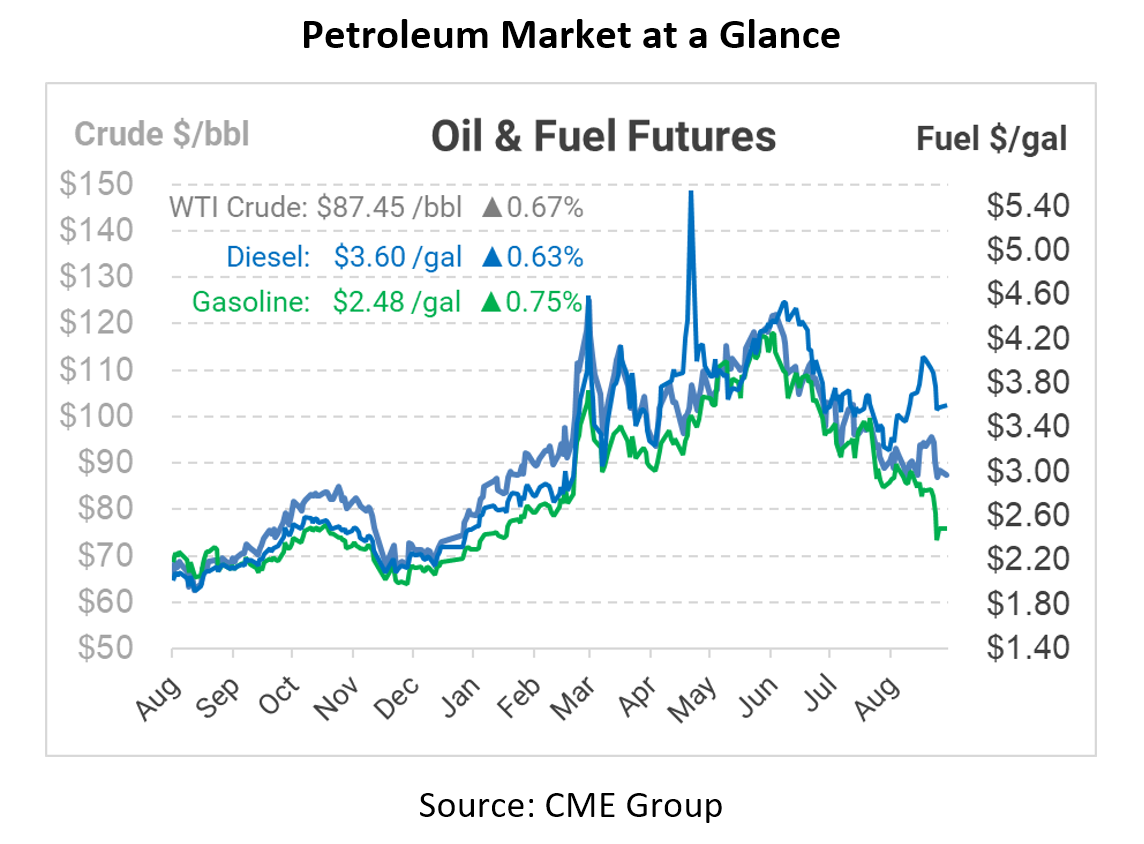

The decision follows OPEC’s technical committee noting that markets are slightly oversupplied currently, but will flip to a 300 kbpd deficit in 2023. Several commentators have noted that OPEC has grown comfortable with oil in the $90-$100 range and does not want to see erosions in their margins after slashing market share for so long. On the other hand, a Reuters analyst warned that higher oil prices will simply worsen the global economic situation, which could ultimately result in crashing demand and prices cratering down to $50/bbl.

OPEC has tried many times in the past to manage global markets – sometimes successfully, but often overtightening too soon or increasing supplies to rapidly. We’ll see if they can achieve their objective of squeezing oil markets for higher prices without triggering an even deeper recession.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.