OPEC Boosts Output as US Enters “New Phase” of Coronavirus

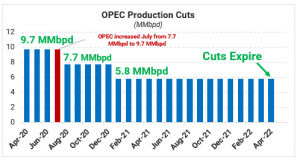

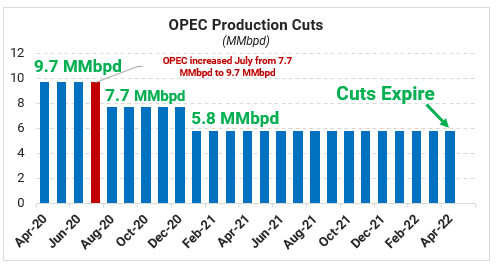

After extending historic 9.7 MMbpd cuts through July, OPEC+ is now slowly unwinding its production cuts, moving to 7.7 MMbpd. That level will hold through December, downshifting again in January to 5.8 MMbpd. With global oil demand still well below normal levels and coronavirus cases rising around the world, many see the increase as a key test for oil market stability – can global markets absorb another 2 million barrels of oil per day?

Rising production accompanies announcements in the US that the country is entering a “new phase” of the pandemic, according to White House coronavirus coordinator Dr. Deborah Birx. Although COVID-19 cases were initially concentrated in major population centers, cases are now rising in rural communities as well. Birx continues urging that all Americans wear masks and socially distance while in public to help curb the spread.

While markets are geared to look ahead, oil companies are still licking their wounds financially. Exxon Mobil posted its worst loss in its 150-year history, while Chevron posted thirty-year record losses. Oil companies were just beginning to expand and invest in new capital expenditures when the virus hit, leading to high spending while revenue was collapsing. The whipsaw response to curtail excess costs will keep the US oil economy in shambles for a while. Baker Hughes’ rig count data echoed the dire sentiment, showing a one-rig drop to 180 rigs – down 590 rigs from a year ago.

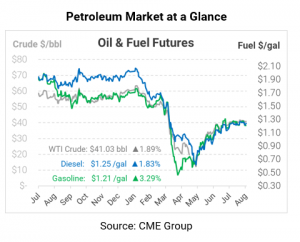

Despite hoards of bearish news including more OPEC production, US dollar gains, and rising COVID-19 cases, oil prices are finding some strength this morning. WTI crude is trading at $41.03 this morning, up 76 cents (1.9%) from Friday’s close.

Fuel prices are also moving higher. Diesel is trading at $1.2464, up 2.2 cents since Friday. Gasoline is seeing even larger gains, trading at $1.2096, up 3.9 cents (+3.3%). As we reported last week, gasoline’s roll from August futures to September futures caused overall prices to fall, and gasoline is now several cents behind diesel. Expect spreads to widen as we near the September 15 conversion to winter-spec gasoline.

This article is part of Daily Market News & Insights

Tagged: COVID-19, oil producers, opec, rig count

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.