OPEC+ and Texas RRC Considering More Cuts

On Tuesday, WTI Crude finished down slightly while Brent crude finished up slightly. Some of the optimism stemmed from European countries and some US cities and states beginning to ease up on their quarantines. For the most part, social distancing recommendation remain in place; however, public areas such as restaurants and other businesses are beginning to open for business. These businesses have many new guidelines and restrictions in place to help protect customers and staff but are part of the first wave of life getting back to some semblance of normal once again. Crude is up in early trading this morning on this coronavirus optimism and on somewhat bullish inventory news from the API.

OPEC+ is considering scheduling a meeting in May, ahead of their regularly-scheduled meeting in June. Their decision to meet early may be related to the US and other non-OPEC+ countries committing to actual production cuts, as opposed to allowing economically-required shut-ins to happen naturally. On that note, the Texas RRC will meet on May 4th to vote on a production cut proposal. The proposal would cut 20% of Texas production (1 mmbpd) if the US, other than Texas, would in aggregate cut another 3 mmbpd.

The API’s data last night:

The API reported a smaller-than-expected build for crude of 10.0 MMbbls versus an expected build of 10.6 MMbbls. At Cushing, stocks rose with a build of 2.6 MMbbls. The API reported that gasoline had a smaller-than-expected build and distillates had a larger-than-expected build. The EIA will report numbers later this morning.

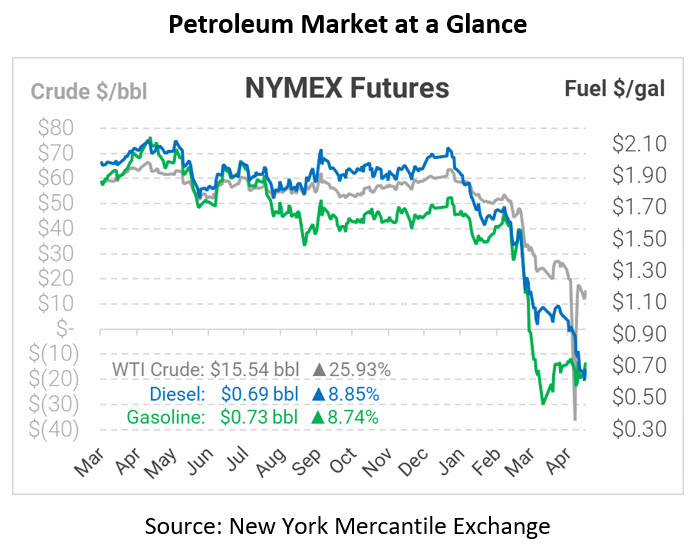

Crude prices are up this morning. WTI Crude is trading at $15.54, a gain of $3.20.

Fuel is up in early trading this morning. Diesel is trading at $0.6866, a gain of 5.6 cents. Gasoline is trading at $0.7255, a gain of 5.8 cents.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.