Oil Weakened by Unlikely Source – Coronavirus

Yesterday, crude prices fell in the morning after the market dismissed worries of supply concerns in Libya, but then finished the day relatively unchanged on sparse fundamental news. Crude prices are down this morning as demand risks from the coronavirus and bearish remarks from the International Energy Agency (IEA) outweigh concerns over continued disruptions to Libya’s crude output.

The recent virus outbreak shows just how vulnerable oil markets are to a vast array of potential risks. According to Goldman Sachs, oil markets are likely to take a hit from China’s deadly coronavirus, with aviation fuel suffering the most. The virus that originated in Wuhan could result in global oil demand falling by up to 260 kbpd in 2020, with jet fuel accounting for around two-thirds of the loss. Ultimately jet fuel markets are expected to decline most if this outbreak persists given the likely decline in regional air travel.

In other fundamental news, the head of the IEA, Fatih Birol, said he expects the market to be in surplus by 1 MMbpd in the first half of this year. This aligns with the EIA’s current market forecast, which projects flat inventories in Q1 leading to 1 MMbpd builds in Q2. In the latter half of the year, though, demand strengthens and supply declines, leading to a net draw by the end of the year. Next year, the EIA is forecasting a net draw in inventories for the first time since 2017.

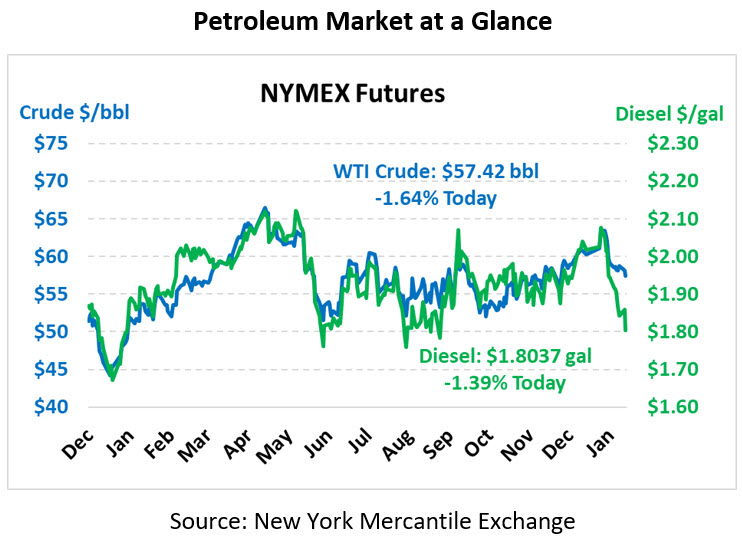

Crude prices are down this morning. WTI Crude is trading at $57.42, a loss of 96 cents.

Fuel is down in early trading this morning. Diesel is trading at $1.8037, a loss of 2.6 cents. Gasoline is trading at $1.6137, a loss of 2.3 cents.

This article is part of Crude

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.