Oil Up 15% as US Demand Shows Upward Trend

Oil markets are on track to set a multi-month record with a 5-day up streak if current trends hold. With the OPEC+ price war in the rearview mirror, markets are more comfortable bidding up prices despite weak demand. Inventory builds this week are expected to be smaller than recent builds, and demand seems to be slowly ticking higher.

Speaking of demand, the EIA published an article recently that highlighted the huge drop in fuel demand. Refinery inputs fell to a low of 12.8 MMbpd in mid-April, more than 20% below the average level for this time of year. In more positive news, however, late-April throughput picked up to 13.2 MMbpd, which may signal a bottom in dampened fuel demand. Leading the charge higher was gasoline demand, and jet fuel seems to have bottomed in early April. Diesel demand, on the other hand, remains depressed, though not as much as other products have been.

Additionally, the EIA reported that refineries are producing record quantities of diesel demand while cutting gasoline output. Refineries can optimize their output to a limited degree based on market prices, but there are constraints on how much they can change. Crude typically yields twice as much gasoline as diesel fuel, but recently refineries have been testing the limits of maximum diesel capacity, avoiding gasoline production at all costs. At 40% in April, current refinery yields of distillates mark the highest level on record. While optimized flows are a recurring market feature, the massive change in product yields shows that refineries have more flexibility than previously thought to increase distillate output.

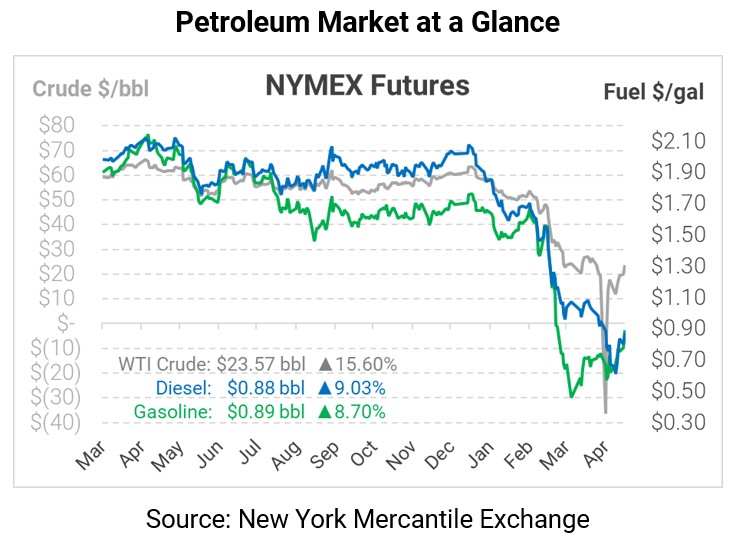

Oil markets are posting huge gains this morning, despite no particular catalyst other than the on-going trend of reopening markets. Crude oil is trading at $23.57, up $3.18 – a whopping 15.6% – from Monday’s closing price.

Fuel prices are also soaring along with crude. Gasoline prices, which once again retook the preeminent price position over diesel, are trading at $.08930, up 7.2 cents (8.7%). Diesel prices are attempting to catch up this morning, trading at $0.8756 with a gain of 7.3 cents (9.0%).

This article is part of Crude

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.