Oil Sheds Another 4% on EU COVID Fears

Oil markets are seeing yet another sell-off this morning, driven by renewed lockdowns in Europe that threaten the oil demand recovery. Germany, the heaviest fuel consumer in the EU, extended lockdowns into April. France and Poland have also announced lockdown measures. Many EU countries have experienced hiccups in their vaccine rollout program, which is threatening the 2021 demand outlook. Last week’s IEA report included a 2.5 MMbpd cut to the 2021 global demand forecast, a signal that analysts are unsure about the future. On the other hand, several major banks reiterated this week their positive outlook for oil and economic growth.

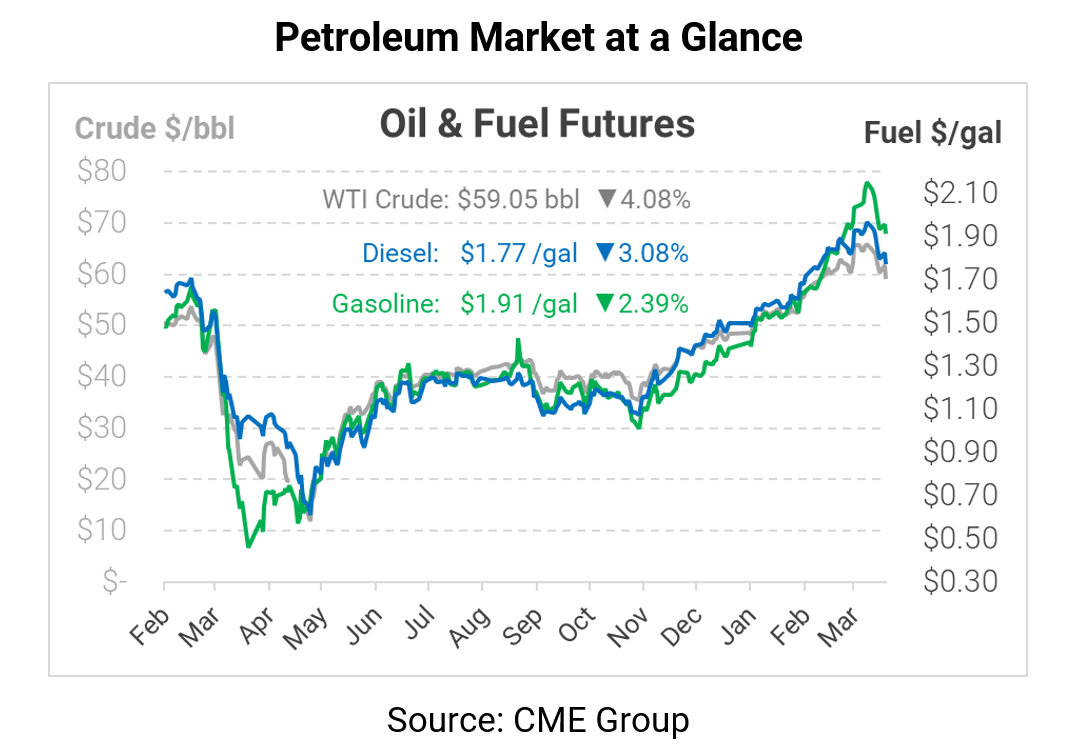

Today is an important test for crude oil prices, since the contract has fallen below $60/bbl only a handful of times over the past month. The last time the contract closed below $60/bbl was March 2, and the last time it happened two days in a row was in mid-February. Market bulls have so far shown their dominance, keeping prices elevated for over a month. Traders are now watching to see if the bulls will rear their head again, or if prices are destined to continue falling until European demand improves.

In biofuels news, discretionary blending of biofuels is slowing in some parts of the country as feedstocks grow more difficult for producers to procure. Limited soybean supplies and higher prices are suppressing incremental blending except in markets with bio mandates or incentives, such as Minnesota, Illinois, and California. RINs prices have risen to multi-year record highs in recent weeks, suggesting petroleum-based fuel supply is outpacing biofuel blending. As refineries return to normal operations and switch from importing fuel (which requires buying RINs) to exporting fuel (which does not require RINs), expect RINs prices to cool, which will lower fuel prices while increasing biofuel costs.

This morning, crude oil price losses are holding steady, and even deepening a bit. Crude oil is currently trading at $59.05, down $2.51 (-4.1%) from Monday’s closing price.

Fuel prices are also steeply in the red this morning. Diesel is trading at $1.7730, down 5.6 cents (-3.1%) from yesterday’s closing price. Gasoline prices, which are performing the strongest so far today, are currently $1.9129, down 4.7 cents (-2.4%).

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.