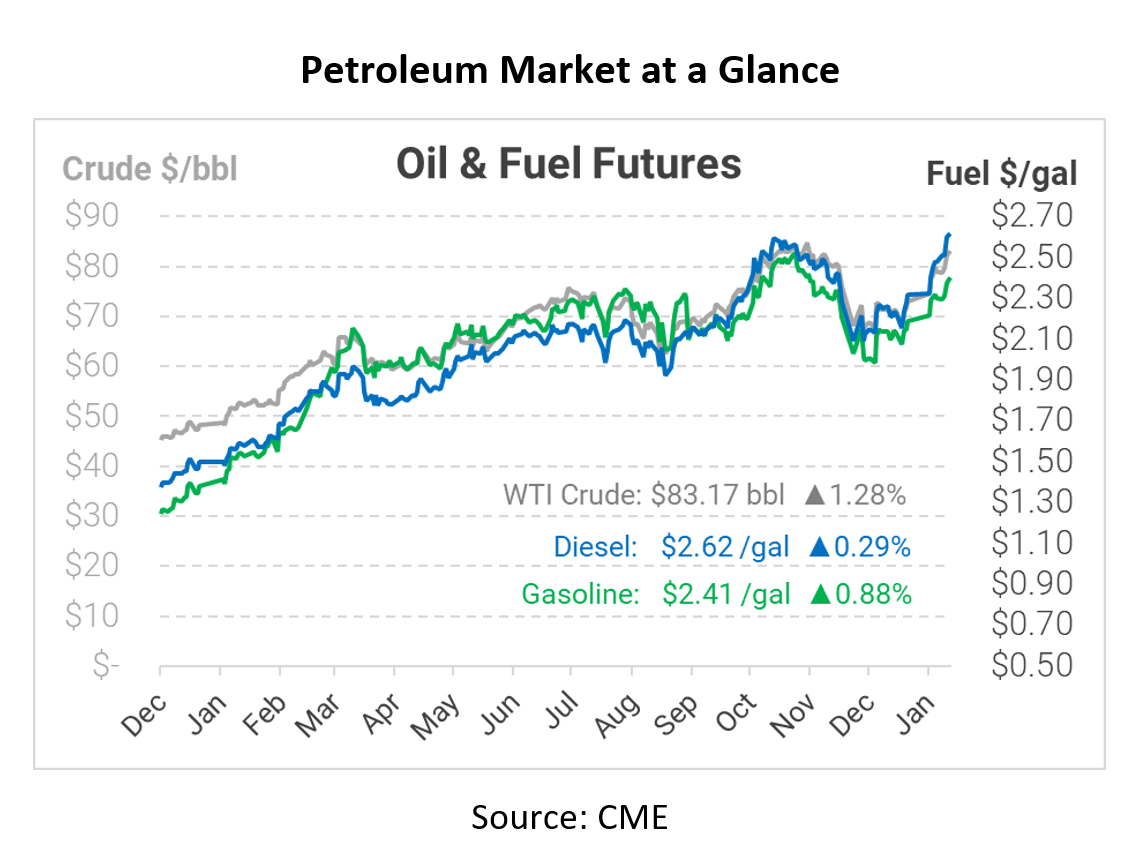

Oil Rockets Near Multi-Year Highs, Despite China Oil Release

Oil prices are back on the rise after taking a brief pause yesterday, with WTI crude oil trading within striking distance of $83/bbl. The high-water mark is $84.65, which was the closing price on October 26, 2021. Beyond that price, we’d have to look back to October 2014 for comparably high prices – back when prices were tumbling from over $100/bbl. Fuel prices are also gaining steam, with diesel surpassing $2.60 this week while gasoline moved closer to $2.40.

Surprisingly, major headlines this morning are bearish, yet prices keep rising. China has agreed to release oil from the strategic reserves to meet demand for their Lunar New Year, one of the most celebrated national holidays in China. The holiday is one of the largest annual human migrations on earth – far larger than US travel holidays like Thanksgiving or Memorial Day. Still, COVID restrictions threaten to limit the demand impact, since China has taken a very tough stance on the pandemic.

Impending cold weather will always present a challenge for fuel markets this week. Although the storm should blow through without any significant impact on fueling infrastructure (hopefully), it will certainly increase demand for heating oil after a more mild early winter. Cold weather will weigh on diesel prices, especially in northern areas where kerosene and winter additives will be necessary to prevent gelling.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.