Oil Remains Near Multi-Year Highs, Saudi-Kuwait Deal Stalls

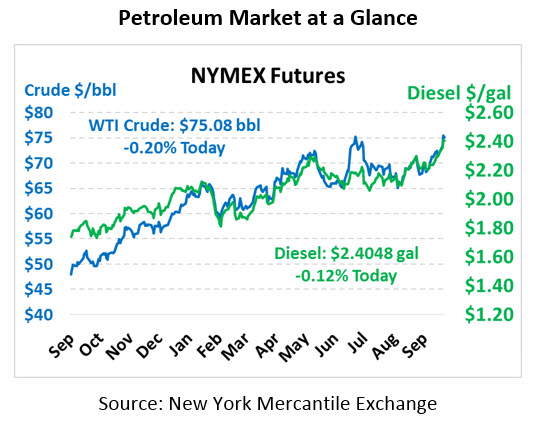

Oil prices are trading flat again after barely moving yesterday. Crude is still hovering at multi-year highs, with diesel peaking up even higher this morning. WTI Crude is currently trading at $75.08, down 15 cents.

Fuel prices are trading lower this morning. Diesel prices are currently $2.4048, up 0.3 cents. Gasoline prices are $2.1182, shedding 0.9 cents.

The API released its weekly inventory data yesterday, showing a strong Cushing crude stock build but otherwise demonstrating a more bullish outlook than market expectations. Crude stock builds were under a million barrels, compared to a two million barrel build. As refineries go through maintenance season, crude remains in stocks while fuel inventories are drawn down.

Saudi Arabia has been the source of a good deal of market angst. On one hand, Trump is pushing Saudi Arabia to increase their production to offset Iranian supply losses, but to little avail. While Saudi Arabia and Russia did agree to increase production before the last OPEC meeting, the country has since noted that their customers are not ordering more fuel so they will not increase production. Saudi Arabia and Kuwait are in discussions over oil production in the Saudi-Kuwait neutral zone, though talks seem to have stalled due to Kuwait’s insistence that Chevron not operate in the area.

Weekly Round-Up

Bloomberg: Oil Shock Has Already Started in Emerging Markets

SP Global Platts: Trump ramps up Saudi, OPEC criticism to little effect so far

Reuters: Iraq aims to boost light crude exports to 1 million bpd in 2019

Bloomberg: Putin Tells Trump to Blame Guy in the Mirror for High Oil Prices

American Trucking Association: ATA Statement on North American Trade Agreement

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.